As DAOs evolve into complex, mission-driven organizations, the need for confidential DAO treasuries has moved from a niche concern to a strategic imperative. In a landscape where on-chain transparency can inadvertently expose sensitive financial details, DAOs are increasingly adopting advanced privacy-preserving technologies to protect their most critical assets and governance processes.

Why Transparency Alone Isn’t Enough for DAO Treasuries

Traditional DAO treasuries leverage the openness of blockchains to foster trust and collective oversight. However, this transparency comes with trade-offs. Full public visibility can make DAOs vulnerable to targeted exploits, front-running attacks, or even social engineering aimed at key contributors. Strategic asset movements, partnership negotiations, or liquidity planning are often best kept confidential until execution.

Recent research underscores how privacy-preserving governance mechanisms help mitigate the risks of bandwagon voting and vote-buying by shielding voter identities and preferences. This ensures decisions reflect genuine consensus rather than external pressures or manipulation. The same principle applies to treasury management: confidentiality protects not just assets but also strategic intent.

The Rise of Confidential Computing in Private DAO Asset Management

The integration of confidential computing is redefining private DAO asset management. By leveraging hardware-based Trusted Execution Environments (TEEs), DAOs can process sensitive financial data without revealing it to either node operators or external observers. Frameworks like the Confidential Consortium Framework (CCF) empower developers to deploy secure applications that maintain both decentralization and data privacy, even on untrusted infrastructure (source).

This approach enables confidential asset balances and private spending DAOs, where only authorized parties can view or initiate transactions. As a result, DAOs no longer have to choose between security and transparency, they can achieve both through selective disclosure.

Top Privacy Technologies in Confidential DAO Treasuries

-

Confidential Consortium Framework (CCF): Developed by Microsoft, CCF leverages Trusted Execution Environments (TEEs) to enable confidential computing for DAOs, ensuring sensitive treasury operations remain private even on untrusted infrastructure.

-

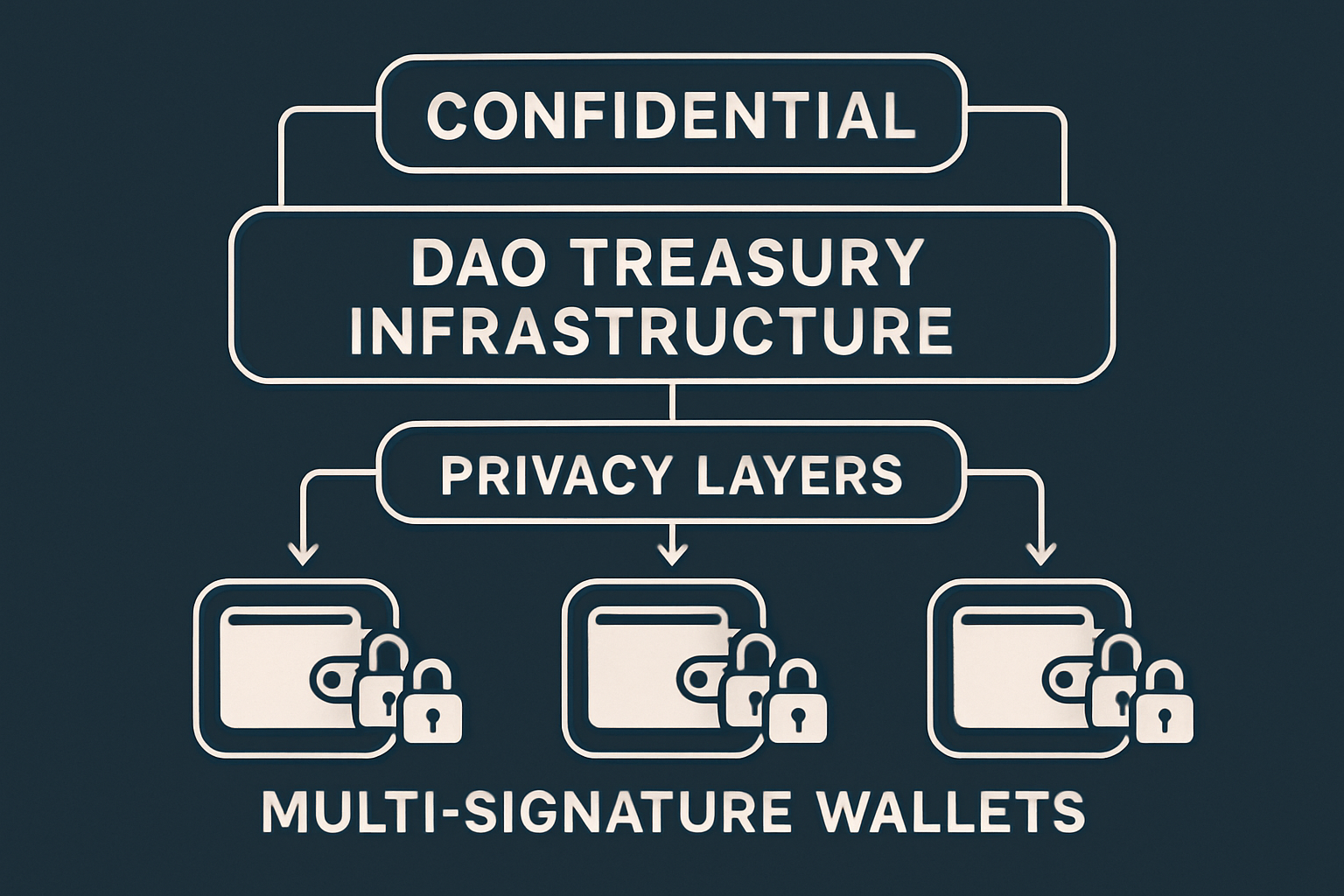

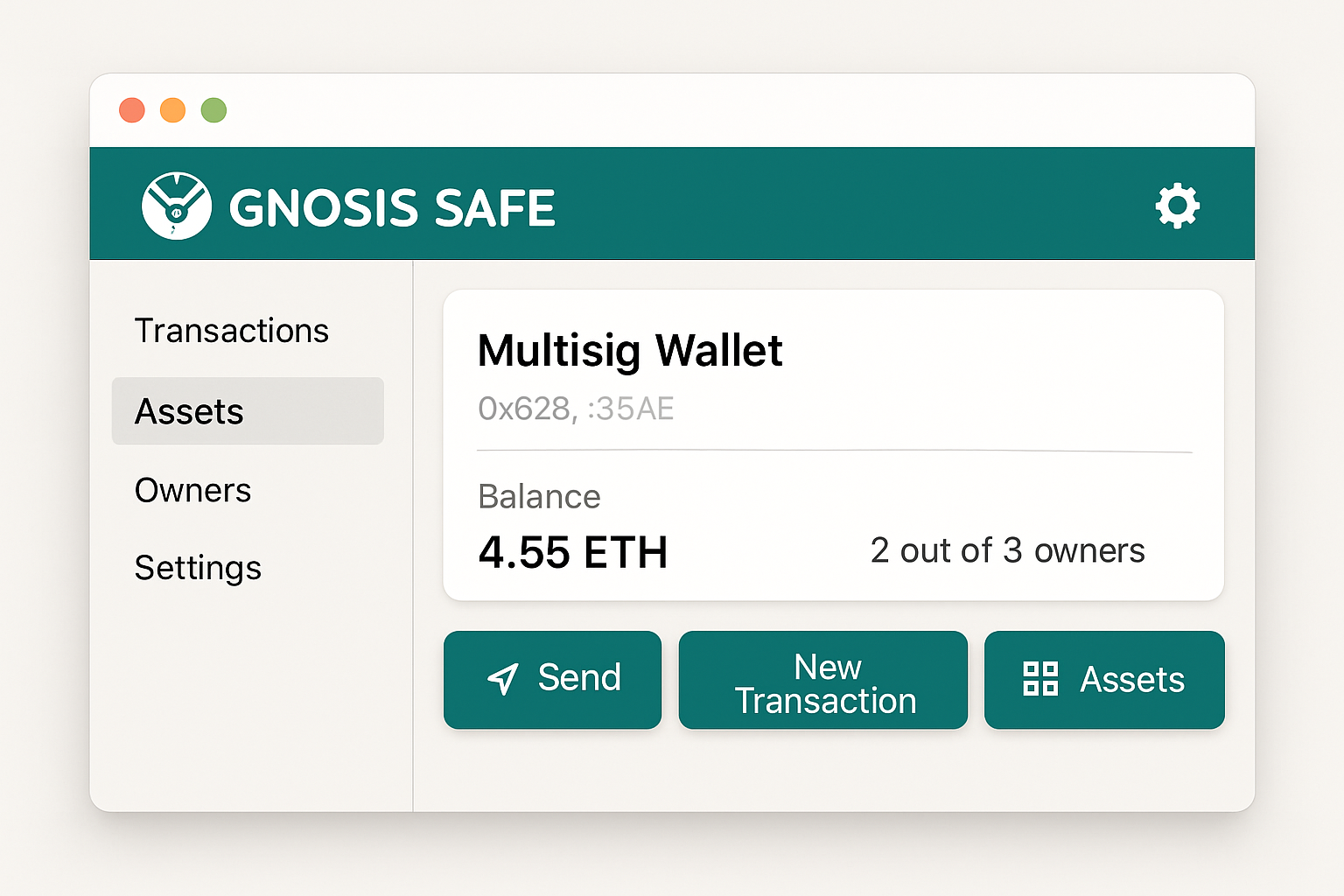

Multi-Signature Wallets (e.g., Gnosis Safe): Platforms like Gnosis Safe require multiple approvals for treasury transactions, reducing single points of failure and enhancing asset protection through collective control.

-

Threshold Signature Schemes (TSS): Implemented by projects like Fireblocks and Curvegrid, TSS enables secure, distributed signing of transactions, ensuring no single party can access or move DAO funds independently.

-

Aztec Protocol: Aztec Network provides privacy-focused smart contracts and confidential transactions on Ethereum, allowing DAOs to shield sensitive financial data while interacting with DeFi protocols.

-

Snapshot with Privacy Plugins: Snapshot, a popular DAO voting platform, now supports privacy-preserving plugins (such as privacy strategies) that enable confidential on-chain or off-chain voting, mitigating risks like vote bribery and social signaling.

Strategic Risk Management: Safeguarding Assets Without Compromising Governance

The cornerstone of effective DAO treasury privacy is robust risk management paired with cryptographic governance tools. Multi-signature wallets and threshold signatures have become standard for protecting against unauthorized transactions, requiring multiple approvals before assets move out of treasury accounts (source). Meanwhile, non-custodial advisory services such as those offered by Lumida Wealth are helping DAOs optimize liquidity planning while minimizing exposure.

Diversification is another pillar: forward-thinking DAOs allocate funds not just across digital assets but increasingly into real-world assets (RWAs), reducing dependence on volatile native tokens and creating more resilient financial strategies (source). The ability to manage these allocations privately allows DAOs to act decisively without tipping their hand to market participants who may seek to front-run their moves.

Confidential DAO treasuries are not just about hiding numbers – they are about giving decentralized organizations the tactical edge to fulfill their missions without exposing themselves to unnecessary risk. By keeping sensitive treasury data confidential, DAOs can negotiate partnerships, allocate funds to ecosystem growth, and hedge against volatility with far greater flexibility and security. This is especially crucial as DAOs move into new domains such as DeFi protocol governance, private equity-style investments, or cross-chain asset management.

Critically, the privacy layer must not compromise accountability. Modern cryptographic techniques allow for verifiable proofs of solvency and correct governance outcomes without revealing underlying transaction details. In practice, this means a DAO can prove its treasury is solvent or that a vote was conducted fairly – all while keeping the specifics shielded from public view. This balance between DAO financial privacy and verifiable trust is what sets leading confidential DAOs apart from their more transparent but vulnerable counterparts.

Key Pillars of Confidential DAO Treasury Management

Key Benefits of Confidential DAO Treasuries

-

Enhanced Protection of Sensitive Financial Data: By leveraging confidential computing technologies such as Trusted Execution Environments (TEEs), DAOs can securely process treasury transactions and data without exposing critical financial details to the public or potential adversaries.

-

Mitigation of Governance Manipulation Risks: Privacy-preserving governance mechanisms help prevent issues like vote bribery, social signaling, and bandwagon effects by enabling selective privacy in voting, resulting in more authentic and unbiased decision-making.

-

Improved Security Through Decentralized Controls: Utilizing multi-signature wallets and threshold signature schemes ensures that multiple parties must approve transactions, significantly reducing the risk of unauthorized access to strategic assets.

-

Strategic Asset Allocation and Diversification: Confidential treasuries enable DAOs to align investments with their mission, supporting protocol development and ecosystem growth. Diversification into real-world assets (RWAs) provides uncorrelated returns and reduces reliance on native tokens.

-

Stronger Risk Management and Operational Resilience: Confidential treasury practices support robust risk management strategies, including liquidity planning and asset safeguarding, ensuring DAOs can meet operational expenses and remain resilient against market volatility.

Effective private DAO asset management rests on several foundational pillars:

- Selective Transparency: Share only what’s necessary with stakeholders while protecting sensitive strategies.

- Multi-layered Security: Combine threshold signatures, hardware-based TEEs, and strict access controls for all treasury movements.

- Diversified Asset Allocation: Hedge risks by balancing native tokens with stablecoins and real-world assets (RWAs).

- Privacy-Preserving Governance: Use cryptographic voting systems to prevent manipulation and ensure authentic consensus.

- Continuous Monitoring and Auditing: Leverage zero-knowledge proofs and automated monitoring tools for ongoing assurance without sacrificing privacy.

The evolution of these practices is already visible in advanced protocols like Set Protocol’s on-chain asset management approach or ether. fi’s non-custodial solutions. These platforms demonstrate how DAOs can maintain operational agility while safeguarding strategic intent from both internal leaks and external threats.

Real-World Impact: Why Confidentiality Is Now Essential

The rapid growth of DAOs as vehicles for collective investment, protocol development, and digital community building has raised the stakes around treasury confidentiality. As more institutional capital flows into decentralized structures, expectations around privacy, compliance, and professional risk management have never been higher. A single leak of sensitive funding plans or partnership negotiations can impact token prices or derail months of strategic work overnight.

This new era demands that DAOs move beyond basic transparency towards nuanced confidentiality – not to obscure accountability but to enable smarter governance and more resilient communities. With privacy-preserving technologies now maturing across both Ethereum mainnet and emerging L2s, there’s no longer a trade-off between security and decentralization. Instead, the best DAOs will be those who master both.