In the rapidly evolving landscape of Web3, Decentralized Autonomous Organizations (DAOs) have become powerful vehicles for managing collective assets and driving protocol development. As of March 2023, DAO treasuries surpassed $25 billion in managed assets, a milestone that underscores both the opportunity and the risk inherent to this new paradigm. The scale and visibility of these funds make confidential DAO treasury management a strategic imperative for any organization seeking to protect its competitive edge and operational integrity.

Why Confidentiality is Critical for DAO Treasuries

Unlike traditional corporate treasuries, a DAO’s financial operations are typically executed on-chain and visible to the public by default. This transparency, while foundational to blockchain ethos, introduces risks: adversaries can analyze transaction flows, front-run proposals, or infer sensitive strategic decisions from treasury movements. For DAOs engaged in protocol development, partnerships, or asset allocation, exposure of private finances can lead to targeted attacks or lost opportunities.

Confidential asset management in Web3 isn’t just about hiding numbers; it’s about ensuring that strategic financial data – such as upcoming investments, liquidity positions, or risk hedges – remains protected from external scrutiny until disclosure aligns with governance or legal requirements. This balance between privacy and transparency is at the core of next-generation DAO financial privacy frameworks.

Confidential Computing: The New Standard for Treasury Security

To address these challenges, DAOs are turning to advanced cryptographic solutions like confidential computing and Trusted Execution Environments (TEEs). These technologies enable sensitive data processing within isolated hardware environments, ensuring that even node operators or cloud providers cannot access raw financial details. Frameworks such as dstack are transforming TEEs into scalable zero-trust platforms that allow DAOs to execute treasury operations securely across diverse environments without relying on centralized authorities. (Read more on dstack and zero-trust TEEs)

This architecture empowers private DAOs to manage multi-signature wallets, execute confidential votes on resource allocation, and run analytics on sensitive positions – all while maintaining strict confidentiality. For organizations handling millions or billions in digital assets, this level of protection is not optional; it’s foundational.

Evolving Privacy-Enhancing Technologies for DAOs

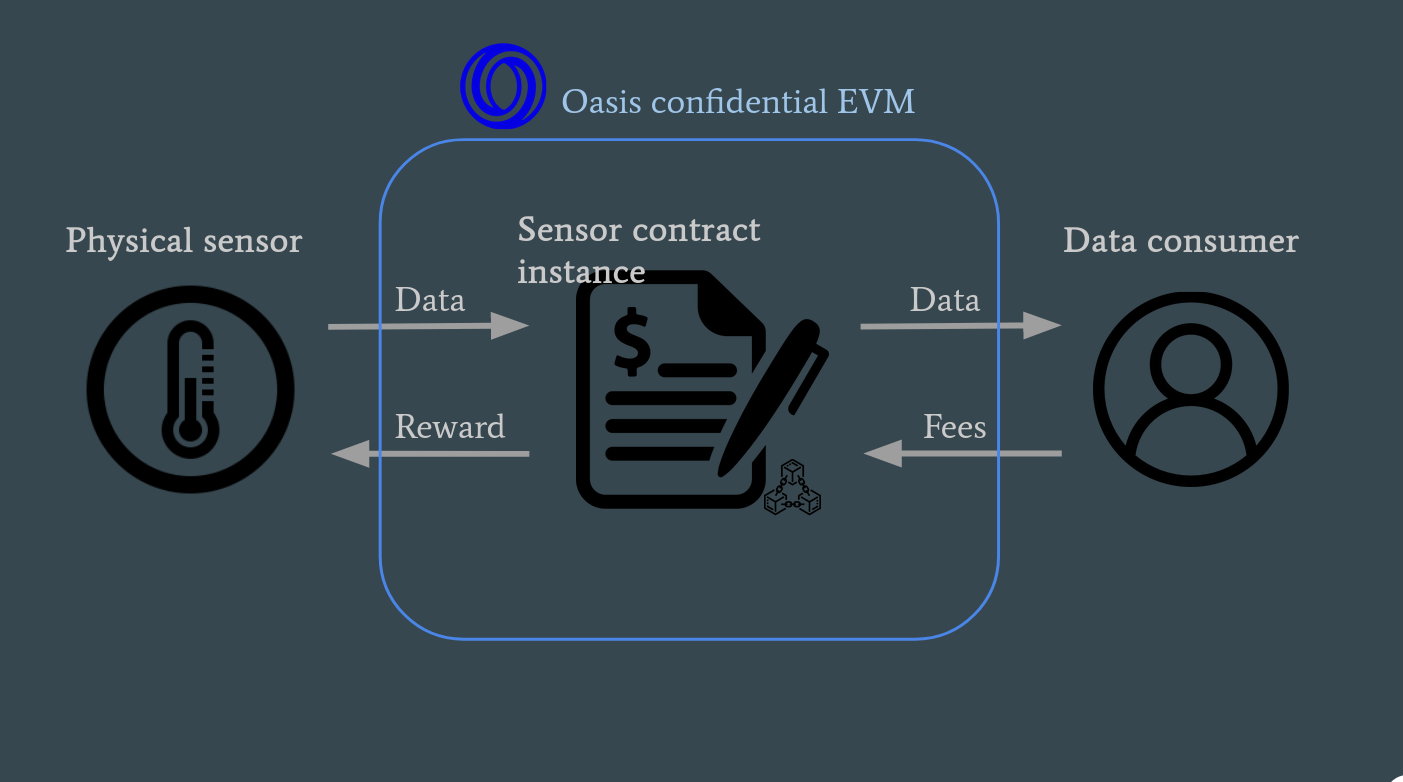

The toolkit for confidential DAO treasury management goes far beyond hardware enclaves. Leading protocols like Oasis Network have introduced features such as confidential voting and encrypted transactions, enabling DAOs to conduct governance and manage funds without publicly exposing sensitive data. The Oasis Sapphire runtime, for example, delivers end-to-end encryption that shields both financial transactions and community decision-making from prying eyes. (Explore Oasis Network’s privacy solutions)

Additionally, decentralized oracles like DECO allow DAOs to verify external financial data provenance without server-side modifications, enhancing trust in reporting while preserving confidentiality. This innovation is crucial for DAOs that rely on external price feeds, audit trails, or off-chain attestations as part of their asset management workflows. (Learn more about DECO oracles)

Key Privacy Technologies in Confidential DAO Treasuries

-

Confidential Computing & Trusted Execution Environments (TEEs): Hardware-based TEEs, such as those enabled by dstack, isolate and process sensitive treasury data securely, ensuring confidentiality and integrity without centralized trust.

-

Privacy-Preserving Decentralized AI: Platforms like Atoma Network integrate confidential computing to protect both AI model parameters and user data, crucial for DAOs leveraging AI in financial decision-making.

-

Oasis Network’s Confidential Governance: Oasis Network provides privacy features like confidential voting and encrypted transactions via its Sapphire runtime, safeguarding DAO treasury activities and governance.

-

DECO Decentralized Oracles: DECO enables verification of off-chain data provenance via TLS proofs, allowing DAOs to confirm the authenticity of financial data while keeping sensitive details private.

-

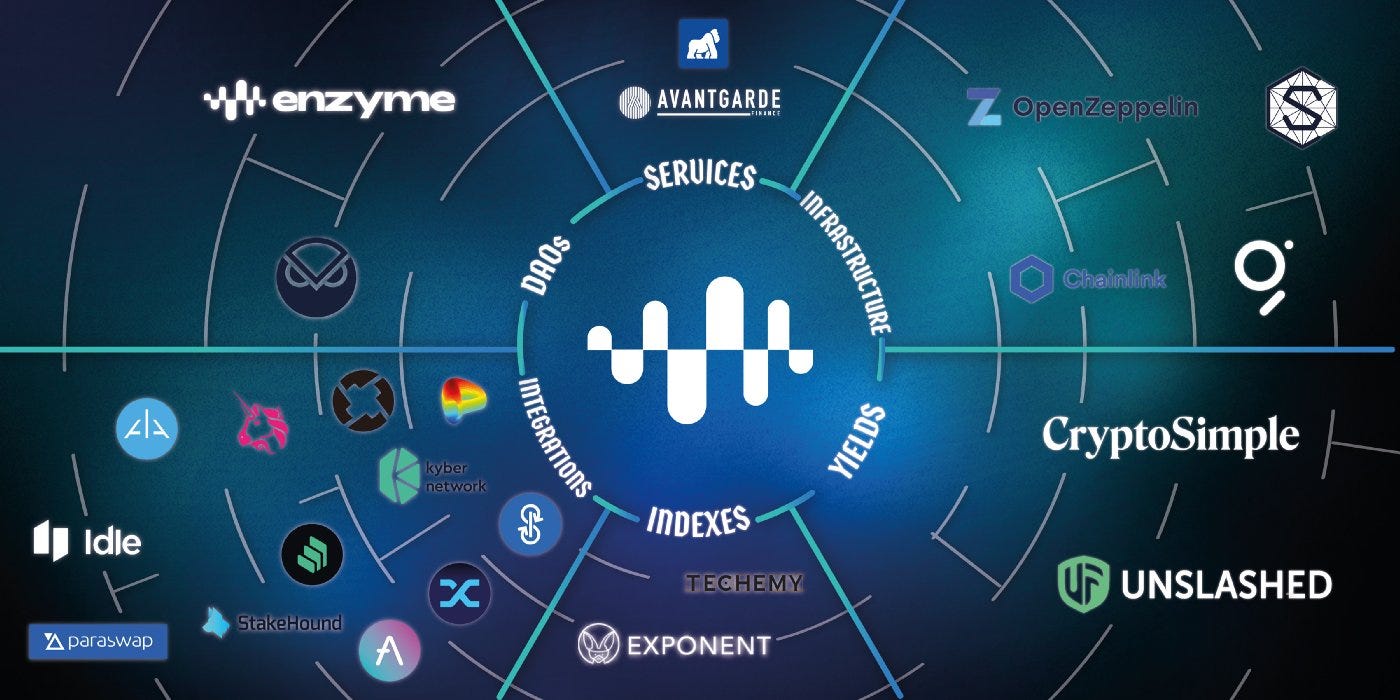

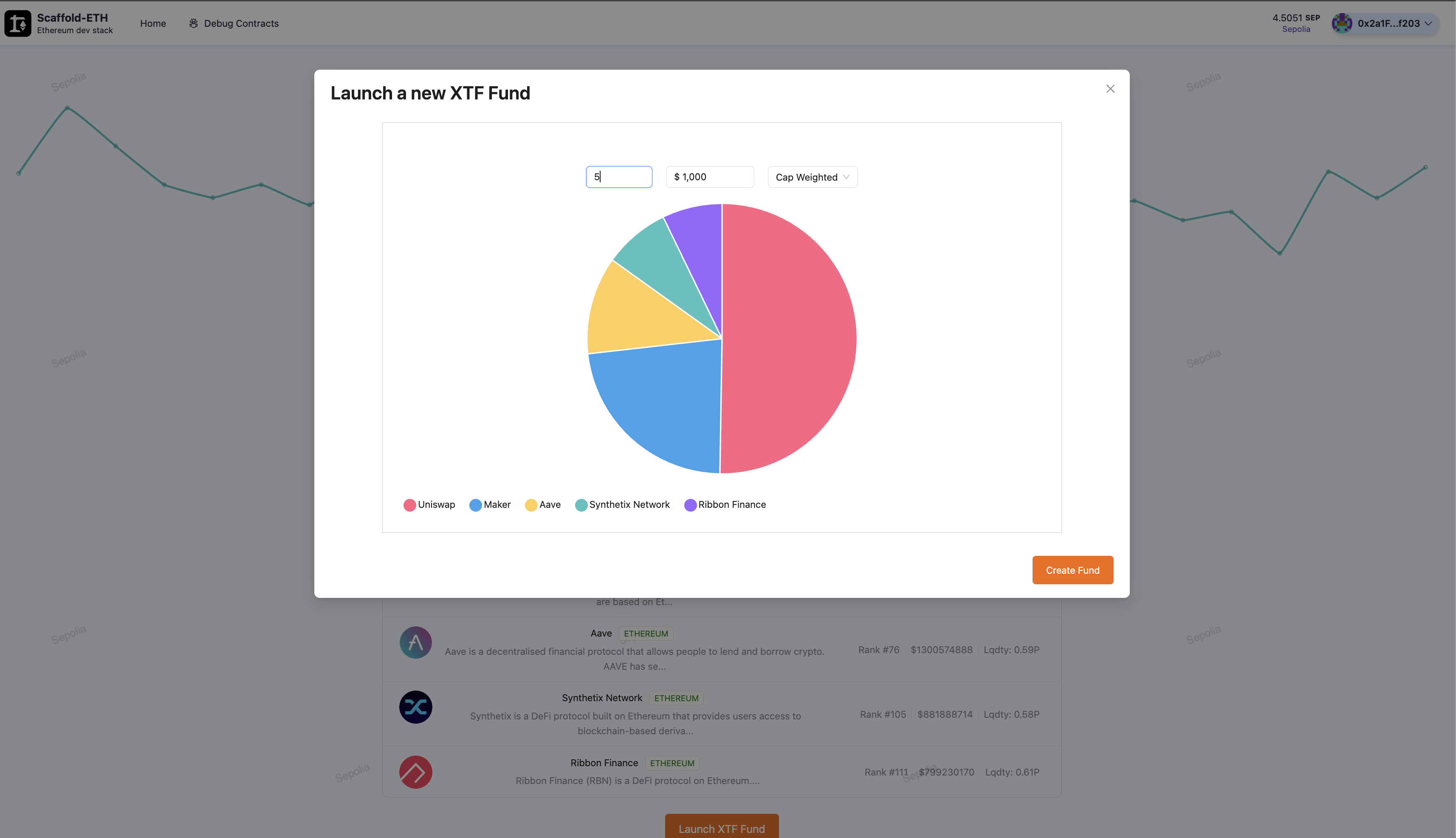

Safe Treasury & 0xScope Transparency Tools: Safe Treasury and 0xScope offer dashboards for fund flows, transfer alerts, and risk management, balancing transparency with selective confidentiality for DAO treasuries.

Integrating Confidential AI in Treasury Operations

As DAOs increasingly leverage AI-driven analytics for risk modeling and asset allocation, the need for privacy-preserving computation grows more acute. Confidential computing platforms like Atoma Network enable decentralized AI models to operate on sensitive financial data without exposing model parameters or user information – even in untrusted environments. This capability is especially relevant for private DAO finances, where predictive algorithms inform high-stakes decisions that must remain shielded from competitors or malicious actors.

The integration of fully homomorphic encryption (FHE) and advanced cryptographic primitives into DAO governance workflows is on the horizon, promising even greater confidentiality without sacrificing auditability or compliance. For now, leaders in confidential asset management Web3 are setting new standards by embracing these layered technologies.

Financial transparency and risk management remain priorities for DAOs, but the sophistication of privacy tooling now allows organizations to calibrate what is shared and when. Solutions like Safe Treasury and 0xScope demonstrate how public dashboards, risk alerts, and fund flow analytics can coexist with selective disclosure. These platforms empower DAOs to meet stakeholder demands for accountability while maintaining a hardened perimeter around strategic data. (See how Safe Treasury and 0xScope support financial transparency)

As DAO treasuries scale past $25 billion, the risks of data leakage, targeted attacks, and regulatory scrutiny intensify. Confidential treasury management is no longer a theoretical advantage but a practical necessity for protocol survival and growth. The market is watching: DAOs that fail to protect their private finances risk not only capital loss but also reputational damage, governance capture, or exclusion from key partnerships.

Discipline and privacy drive consistent returns. In my experience advising private DAOs, the most resilient organizations are those that treat confidentiality as a core asset class, allocating resources to both technological safeguards and operational best practices.

Best Practices for Confidential DAO Treasury Management

Securing a confidential DAO treasury requires more than technical upgrades; it demands a disciplined approach across governance, operations, and risk controls. Here are essential best practices observed among leading confidential DAOs:

Best Practices for DAO Financial Privacy

-

Leverage Confidential Computing with Trusted Execution Environments (TEEs): Utilize hardware-based TEEs, such as those enabled by dstack, to process sensitive treasury data in isolated environments, ensuring that financial details remain confidential and tamper-proof.

-

Integrate Privacy-Preserving AI Platforms: Adopt decentralized AI solutions like Atoma Network that use confidential computing, safeguarding both DAO financial data and AI model parameters during automated decision-making.

-

Implement Privacy-Enhancing Blockchain Networks: Use platforms such as Oasis Network and its Sapphire runtime to enable confidential transactions and encrypted voting, protecting strategic treasury operations from public exposure.

-

Utilize Decentralized Oracles for Secure Data Provenance: Employ technologies like DECO to verify the authenticity of financial data inputs without compromising confidentiality, ensuring that only validated information is used in treasury management.

-

Balance Transparency with Confidentiality Using Treasury Management Tools: Adopt solutions such as Safe Treasury and 0xScope to monitor fund flows, receive risk alerts, and maintain public overviews, while selectively protecting sensitive financial data.

1. Layered Security Architecture: Combine hardware-based TEEs with on-chain privacy protocols to ensure end-to-end protection.

2. Granular Access Controls: Enforce strict role-based permissions for treasury actions and data visibility.

3. Confidential Voting Mechanisms: Use encrypted ballots to protect strategic decision-making.

4. Continuous Audit and Monitoring: Leverage privacy-preserving analytics to detect anomalies without exposing sensitive flows.

5. Regulatory Alignment: Design disclosure frameworks that balance compliance with operational secrecy.

Organizations that implement these measures position themselves to adapt as privacy regulations evolve and as adversaries become more sophisticated. Confidential treasury management is not static; it requires ongoing assessment of new cryptographic primitives, regular threat modeling, and community education on privacy hygiene.

The Road Ahead: Privacy as a Competitive Advantage

The trajectory is clear: as the Web3 ecosystem matures, confidential DAO treasury management will distinguish leaders from laggards. Those who invest early in privacy-enhancing technologies will command greater trust from members, partners, and institutional capital. They will also enjoy strategic latitude, able to negotiate deals, hedge risk, or innovate without broadcasting every move to adversaries or competitors.

For founders, developers, and governance architects, now is the time to treat DAO financial privacy as a first-class design principle. The tools exist; the frameworks are maturing. As more DAOs embrace these advances, expect to see new standards of confidentiality emerge, reshaping how value is created and protected in decentralized communities.