In the shadowy world of decentralized finance, confidential DAOs are rewriting the rules of private treasury management. While public blockchains offer transparency, they expose treasuries to prying eyes, predatory bots, and front-running schemes. Ethereum bots alone are torching over 50% of gas fees, as noted in recent CryptoSlate reports, highlighting the urgent need for privacy tech to scale securely. For DAOs handling multimillion-dollar treasuries, stealth swaps and hidden accumulation strategies aren’t just nice-to-haves; they’re survival tools against MEV extractors and governance attacks.

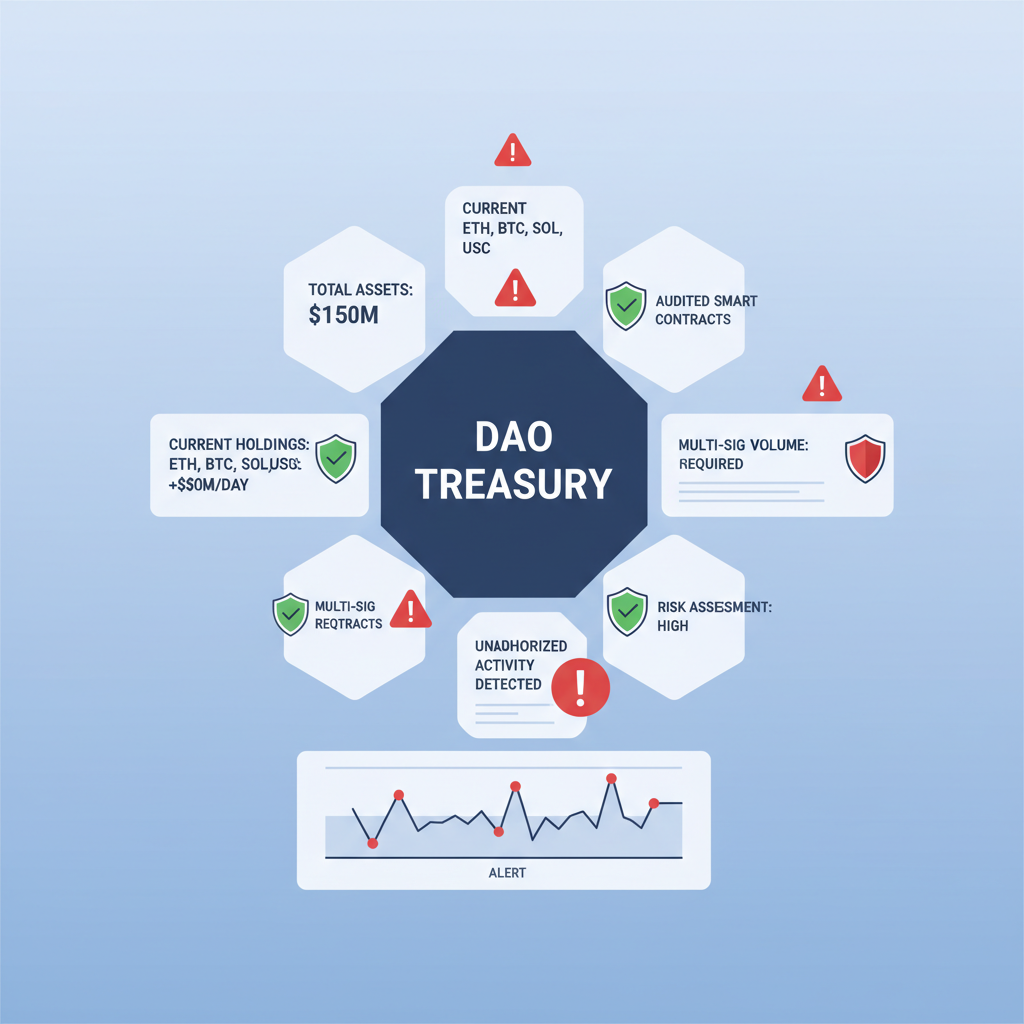

Public ledgers turn every transaction into a billboard. Validators and searchers reorder trades for profit, a tactic rampant on Solana via engines like Jito’s, as detailed in security reviews. DAOs face treasury drains from flash loans or malicious proposals, with tools like Guardrail stepping in for real-time monitoring. Yet, reactive defenses fall short. Proactive privacy, through threshold encryption like Shutter API, enables fair, hidden interactions that keep strategies under wraps.

Why Confidential DAOs Demand Stealth Treasury Tactics

The DAO treasury acts as the financial backbone, funding operations, investments, and governance, per insights from LimeChain and Request Finance. But in a world of on-chain sleuths, even diversified portfolios across assets can’t shield against volatility amplified by visible moves. Deep dives from Coinmetro emphasize spreading risks, yet without concealment, adversaries anticipate every swap or accumulation.

Key Vulnerabilities in Traditional DAO Treasuries

-

1. Front-running by MEV bots: Bots scan the public mempool and insert transactions ahead of yours to profit from anticipated price impacts, eroding DAO treasury value. (Source: CryptoSlate)

-

2. Sandwich attacks: MEV bots reorder transactions to ‘sandwich’ yours—buying before and selling after—forcing unfavorable prices and draining funds. (Source: Medium Solana MEV)

-

3. Flash loan exploits: Attackers borrow huge sums via flash loans to manipulate markets or drain liquidity pools, targeting exposed DAO treasuries. (Source: Guardrail.ai)

-

4. Governance proposal manipulations: Malicious actors use flash loans for temporary voting power to pass harmful proposals and siphon funds. (Source: Guardrail.ai)

-

5. Public exposure: On-chain transparency reveals treasury sizes and addresses, inviting targeted hacks and social engineering. (Source: Request Finance)

Enter confidential DAO treasury practices. IC3’s projects tackle blockchain adoption challenges, while arXiv papers forecast privacy-preserving exchanges akin to Monero’s obfuscation. The Risk Mitigation Framework (RMF) 2025 pushes adaptable standards for public chains, but confidential DAOs leap ahead with built-in secrecy.

Mastering Stealth Swaps for Invisible Token Movements

Stealth token swaps DAOs leverage stealth addresses to mask recipients, slashing risks of targeted attacks. As crypto-news-flash. com explains, these revolutionize privacy by obscuring transaction flows. Imagine executing a massive ETH-USDC swap without bots sandwiching it; that’s the power here. Threshold encryption services like Shutter API empower developers to build this seamlessly, ensuring fair launches and private trades.

Non-custodial platforms such as Avantgarde. finance let DAOs retain control while outsourcing management. Pair this with automated strategies from Steer Pro, where AI turns idle assets into yield engines minus the visibility. No more telegraphing buys that spike prices or sells that crash them. For DAO front-running prevention, stealth swaps create a fog of war, where only the DAO knows the full picture.

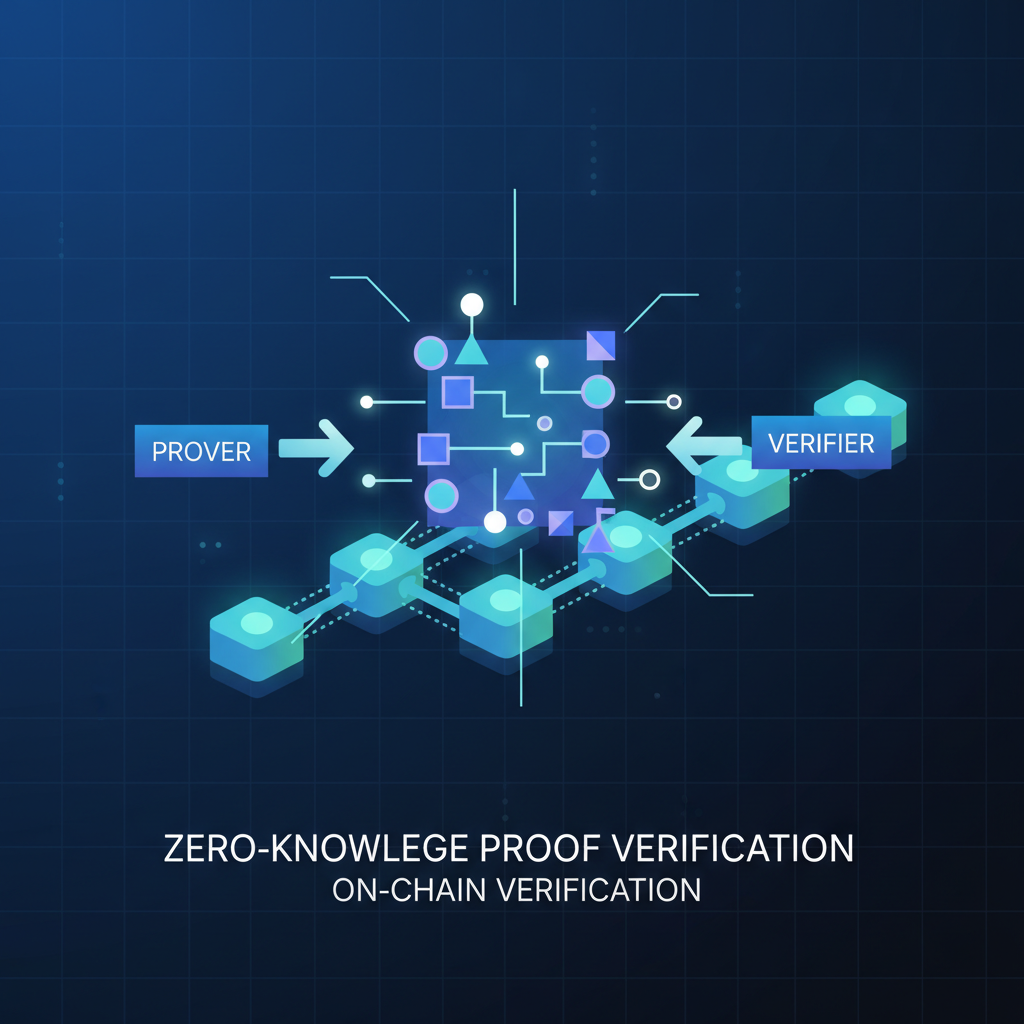

ZKPs and TEEs: The Hidden Layers of Treasury Defense

Zero-Knowledge Proofs (ZKPs) take privacy further, validating balances and compliance without spilling details, as arXiv research (2307.00521) outlines. DAOs prove solvency or investment thresholds on-chain, yet adversaries see zilch. Trusted Execution Environments (TEEs) isolate smart contract execution, shielding data per recent arXiv findings (2412.02634).

Privacy-preserving frameworks like Investcoin obscure individual investments, revealing only aggregates. This layered approach, stealth addresses for inflows, ZKPs for proofs, TEEs for execution, forms an impenetrable treasury fortress. Early adopters report smoother governance, fewer exploits, and bolder strategies, transforming treasuries from static pots into dynamic, hidden powerhouses.

Read more on how confidential DAO treasuries protect strategic assets. These tools aren’t theoretical; they’re battle-tested against the bots devouring Ethereum’s efficiency.

Hidden accumulation strategies take this fortress mentality to the next level, allowing DAOs to build positions without tipping off the market. Picture scooping up tokens during dips, not as a visible whale splashing into liquidity pools, but through fragmented, privacy-cloaked trades. Platforms blending stealth addresses with automated protocols, like those powered by Steer Pro’s AI, execute these invisibly, preserving capital growth while dodging the sandwich attacks plaguing Solana and Ethereum alike.

Building Hidden Accumulation Playbooks

These hidden accumulation strategies blockchain rely on sequencing trades across multiple chains or rollups, obfuscated via threshold encryption. Shutter API shines here, handing developers the keys to encrypt transaction intents before broadcast, ensuring no front-runner peeks. Combine this with Guardrail’s governance watchdogs, and DAOs sidestep malicious proposals that could expose treasury maneuvers.

I’ve seen confidential DAOs thrive by treating their treasury like a covert ops unit: small, randomized swaps over weeks build stacks without price ripples. Diversification isn’t just across assets, as Coinmetro advises, but across privacy layers too. Stablecoins in TEEs, yield-bearing tokens via ZKPs, blue-chips accumulated stealthily, all feeding a resilient portfolio shielded from on-chain forensics.

Opinion: Public DAOs are dinosaurs in this space; their treasuries scream targets. Confidential ones? They’re the apex predators, using privacy not to hide misdeeds, but to outmaneuver a predatory ecosystem. RMF 2025 standards will help, but why wait when tools exist today?

Implementation starts simple. Audit your current setup against IC3’s grand challenges; most DAOs fail on privacy alone. Then layer in non-custodial services from Avantgarde for hands-off pro management, retaining multisig control. AI-driven rebalancing from Steer turns volatility into opportunity, all under the radar.

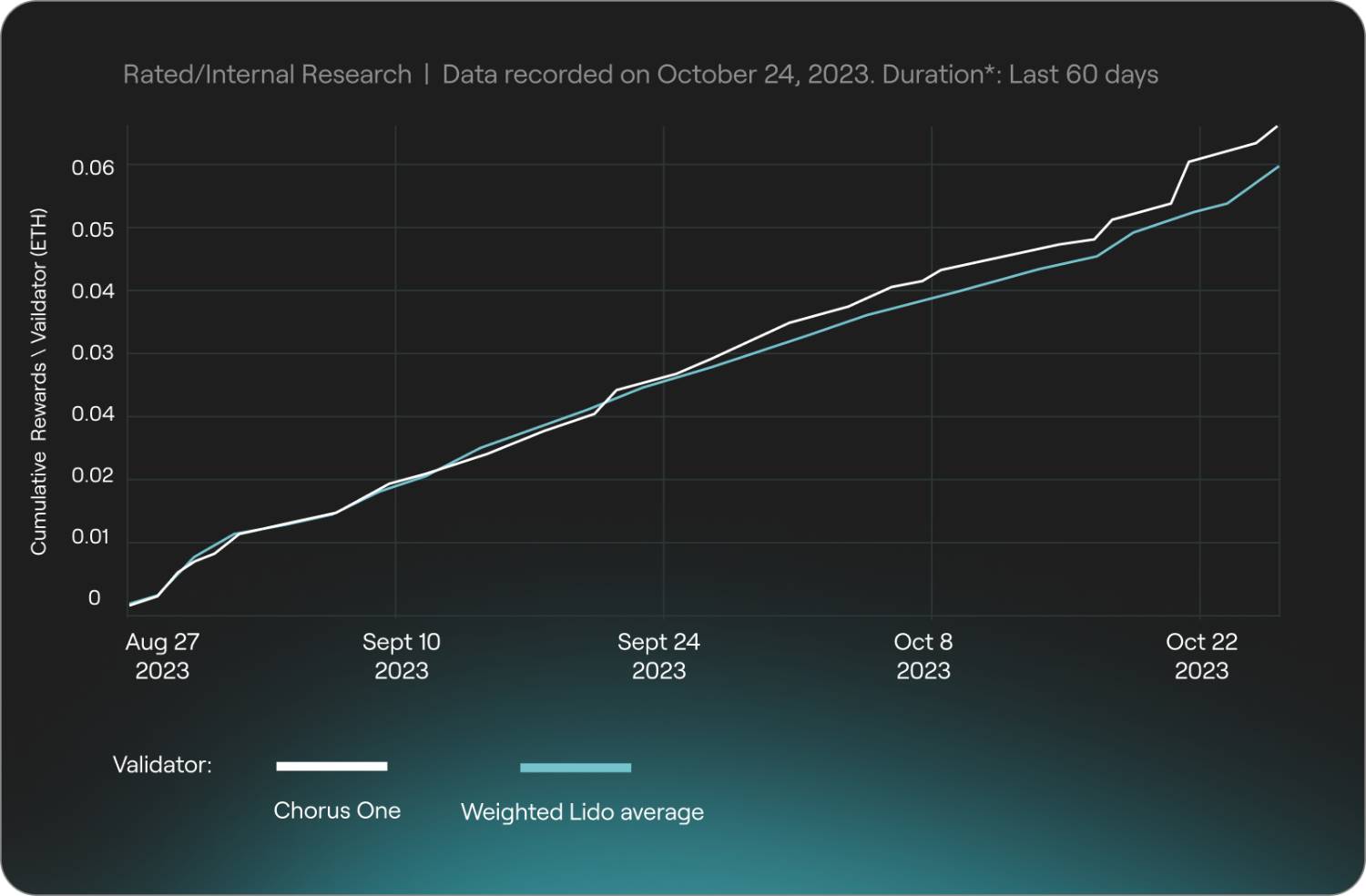

Real-World Wins and Future-Proofing

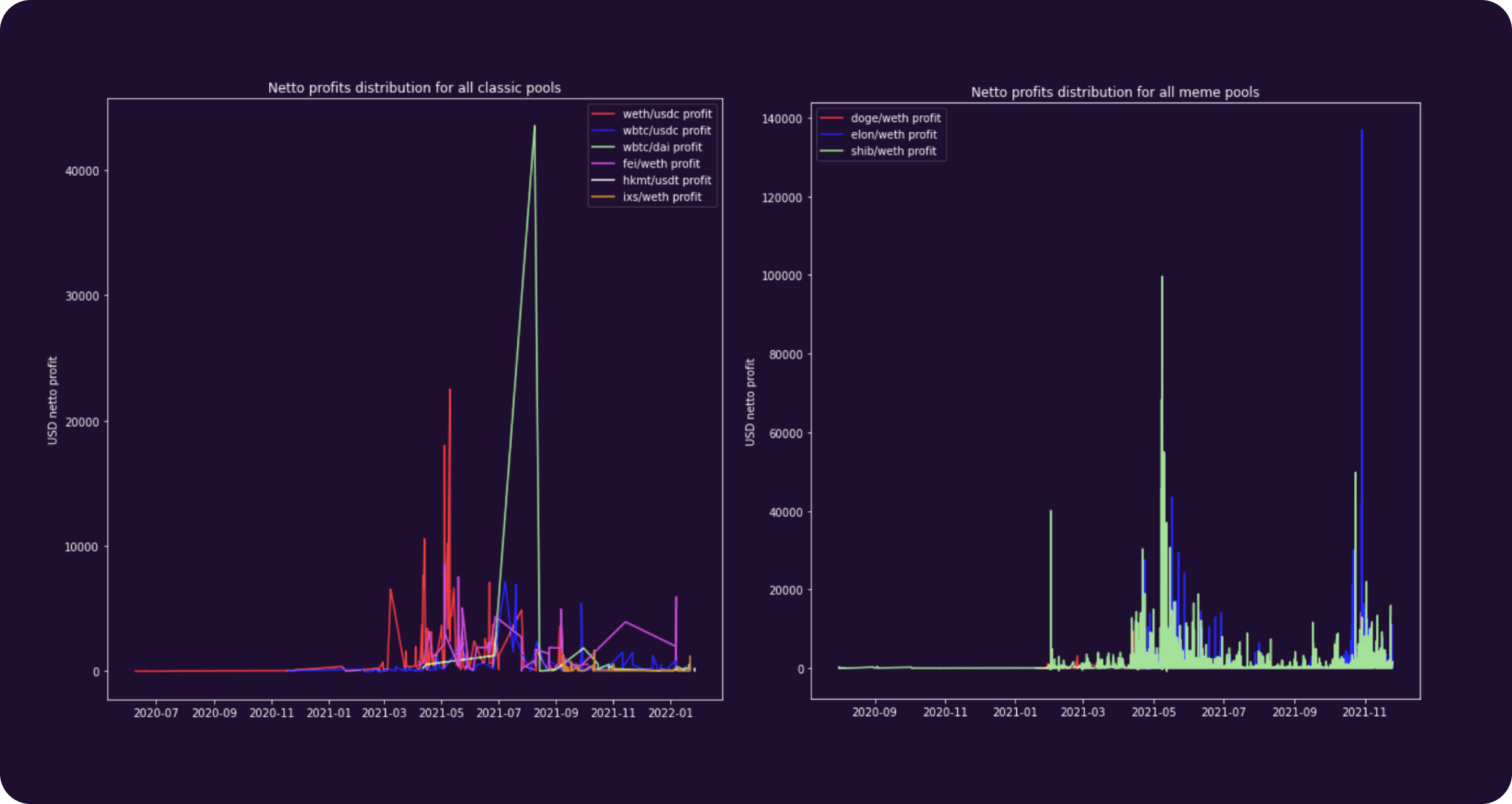

Early adopters report 20-30% better yields from uninterrupted strategies, per aggregated DeFi treasury benchmarks. No more aborted accumulations because bots frontrun your dip-buy. Privacy-preserving investments via Investcoin-like protocols aggregate returns without doxxing allocations, perfect for DAOs eyeing long-term bets on layer-2s or AI tokens.

Looking ahead, arXiv’s latest (2505.02392v3) hints at emergent exchange protocols blending Monero-style obfuscation with Ethereum scale. Confidential DAOs positioning now with stealth tactics will dominate. Check out how confidential treasury management is changing DAO security and strategy for deeper case studies.

Ultimately, private treasury management DAOs succeed by flipping the script: transparency for members, opacity for everyone else. Equip your DAO with these tools, and watch adversaries chase ghosts while you stack silently. Secure communities don’t just survive; they conquer.