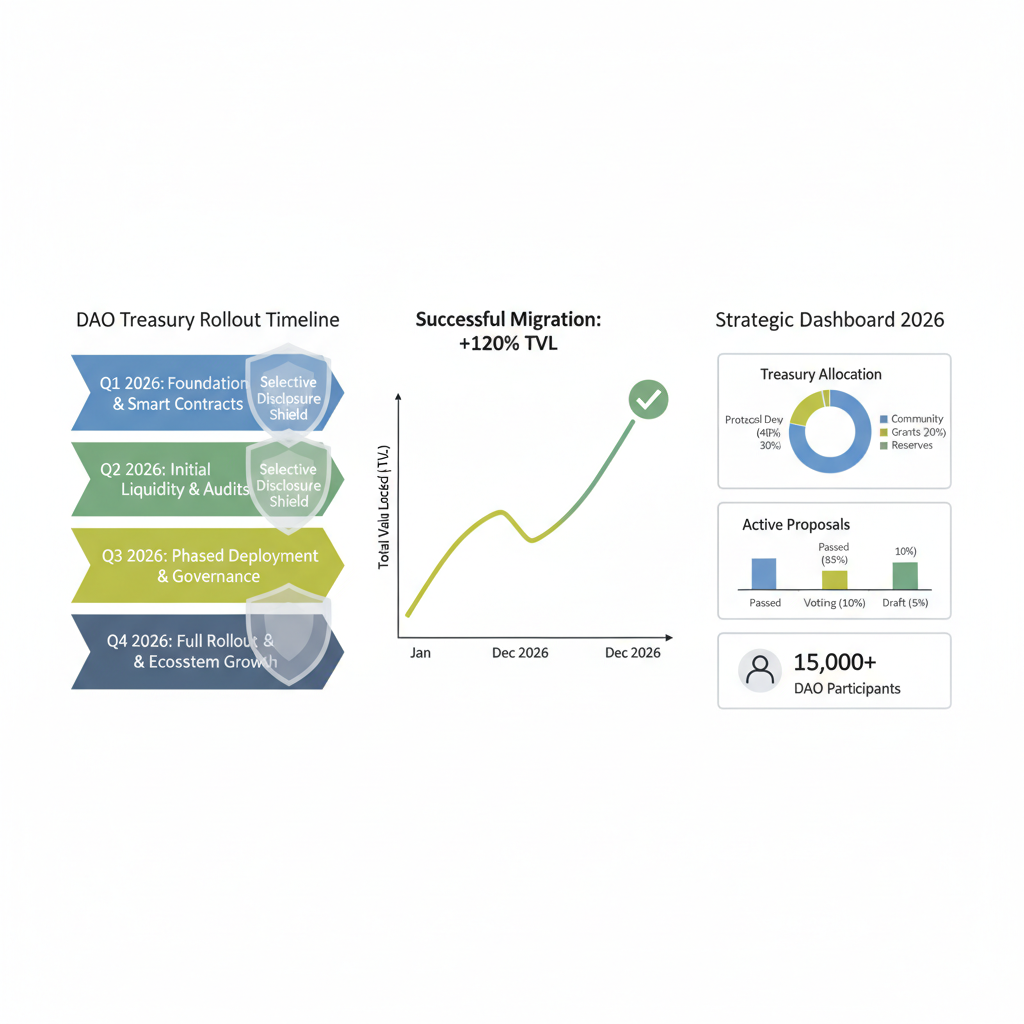

In 2026, as DAOs manage treasuries swelling into the millions, the exposed nature of public blockchains poses a stark vulnerability. Adversaries scan on-chain data to front-run proposals or exploit treasury compositions. Enter zero-knowledge cryptography: a strategic bulwark that verifies transactions and balances without revealing them. This isn’t mere privacy; it’s confidential DAO treasury management, enabling strategic maneuvers shielded from prying eyes.

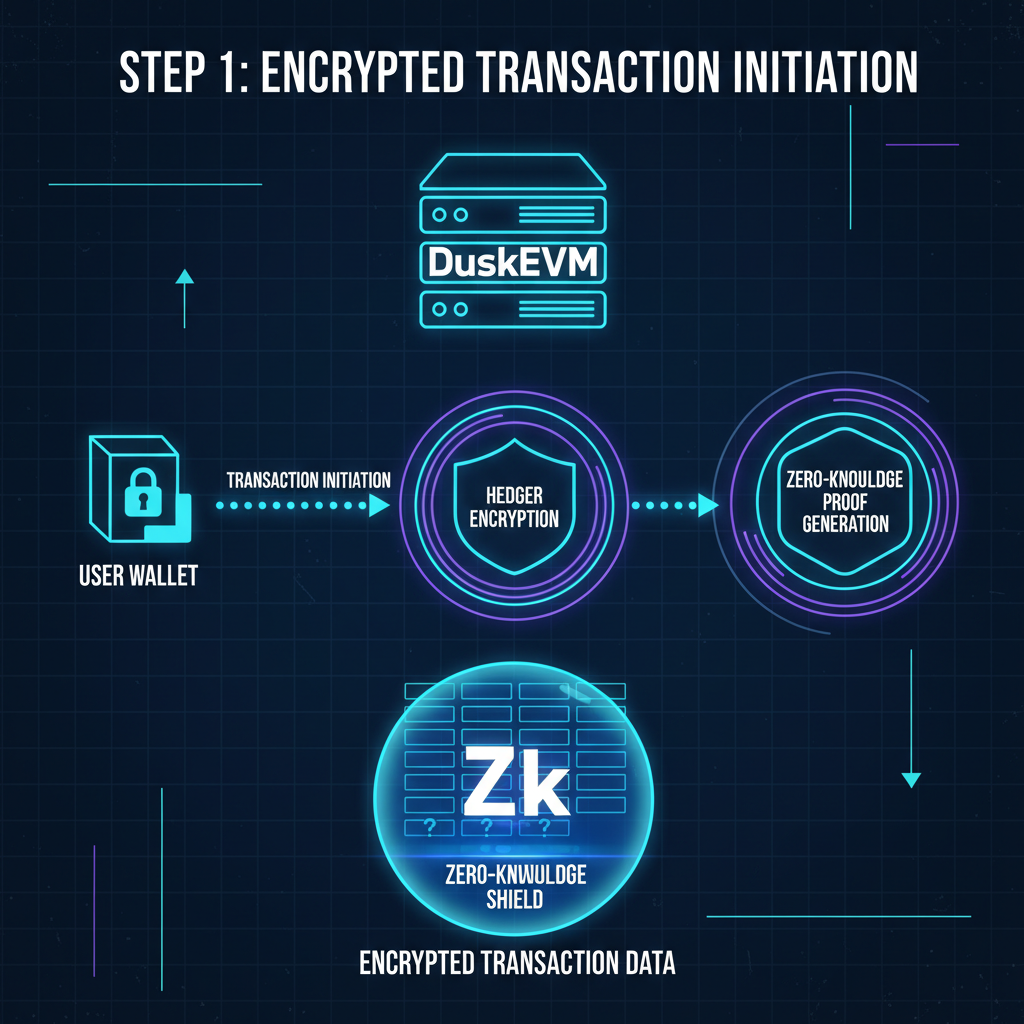

Projects like Dusk Network exemplify this shift. Their platform integrates zero-knowledge proofs for compliant, private transactions, allowing DAOs to prove solvency or regulatory adherence sans disclosure. Dusk’s Hedger protocol layers homomorphic encryption atop ZKPs for confidential EVM operations, a game-changer for DAO privacy tools.

Zero-Knowledge Proofs: The Backbone of Secure DAO Holdings

Zero-knowledge proofs (ZKPs) let one party prove a statement’s truth to another without conveying extra information. For zero-knowledge DAO treasury applications, this means verifying a DAO holds sufficient collateral for a loan or that a multisig threshold passed, all while keeping exact encrypted DAO balances hidden.

Consider Cardano’s zkSNARK Voting Protocol: voters cast anonymous ballots, tallied with cryptographic certainty. No voter identity leaks, yet results are indisputable. Hyperion takes it further, fusing ZK with AI for verified on-chain agents. DAOs deploy these for treasury decisions, like token swaps, without broadcasting positions to arbitrageurs.

This evolution addresses a core DAO flaw: transparency breeds predictability. Strategic actors, from VCs to regulators, thrive on opacity for treasuries. ZKPs flip the script, fostering trust through verifiability minus exposure.

Dusk and DarkFi: Pioneers in Confidential Transactions

Dusk Network stands out for institutional-grade privacy. Their Zero-Knowledge Compliance (ZKC) empowers DAOs to demonstrate KYC/AML adherence without doxxing members. As one source notes, “Privacy is the key piece for institutions. ” DuskEVM’s Hedger brings confidential DeFi to smart contracts, vital for treasury yield farming incognito.

“Hedger brings confidential transactions to DuskEVM using a novel combination of homomorphic encryption and zero-knowledge proofs. ” – Dusk Foundation

DarkFi pushes boundaries with Dusk blockchain confidential transactions, emphasizing uncensorable, private shielded pools. These tools suit DAOs in sensitive sectors like healthcare or finance, where treasury protection demands ironclad secrecy.

Marina Petrichenko’s insights ring true: privacy morphs from ideology to infrastructure. Custodians leverage ZK for solvency proofs, a model DAOs must adopt to attract institutional capital.

Strategic Imperatives for DAO Founders in 2026

Adopting ZK isn’t optional; it’s survival. Buterin’s 2026 DAO vision hinges on ZK privacy alongside on-chain resolution. Without it, treasuries risk surveillance amid data breaches, as DappRadar warns. Founders should prioritize chains natively supporting ZK, like Dusk or Zcash adaptations.

Implementation starts with auditing proofs rigorously, as Binance advises for Dusk’s cryptography. Then, integrate selective disclosure for auditors or regulators. The payoff? Enhanced governance resilience, member retention, and yield optimization free from MEV predation.

In my experience across equity markets, patience yields when processes fortify assets. ZKPs embody this: deliberate, verifiable privacy driving DAO prosperity. As startups pour into FHE-ZK hybrids, per CoinDesk predictions, early adopters will dominate confidential DAO treasury strategies.

Yet realizing this potential hinges on founders bridging theory to practice. Chains like Dusk lead with native ZK support, but custom integrations unlock tailored DAO privacy tools. Take the $100M privacy blockchain from Zero Knowledge Proof: it computes treasury data securely, shielding strategies from competitors while enabling verifiable yields.

Practical Steps: Securing Your DAO Treasury with ZKPs

Strategic deployment begins with assessment. Audit current exposures: public multisigs invite front-running; transparent yields signal to hunters. Then layer ZK selectively, starting with high-value actions like grants or investments.

Post-integration, DAOs report outcomes like Hyperion’s AI agents: execute trades verified yet invisible. Cardano’s zkSNARKs extend this to governance, tallying proposals privately. Such moves not only deter MEV but attract privacy-conscious capital, echoing COTI’s vision of matured confidentiality stacks.

Regulatory tailwinds accelerate adoption. ZKC protocols prove compliance sans exposure, vital as institutions eye DAOs. KuCoin highlights RWAs on ZK layers: security tokens trade confidentially, blending yield with opacity. DappRadar’s surveillance warnings underscore urgency; breaches erode trust faster than gains build it.

ZK Privacy Protocols for DAOs

| Protocol | Features | Use Case | EVM Compat | Compliance |

|---|---|---|---|---|

| Dusk | ZKPs & Homomorphic Encryption | Confidential Transactions & Yield | ✅ | ZKC |

| DarkFi | Shielded Pools | Uncensorable Treasury | ❌ | Selective |

| Zcash | Confidential Transactions | Adapt for DAOs | ❌ | View Keys |

| Hyperion | ZK & AI | Verified Agents | ✅ | Auditable |

| Cardano | zkSNARK | Anonymous Voting & Governance | ❌ | On-Chain Verify |

DarkFi merits special attention for DarkFi DAO privacy. Its shielded components resist chain analysis, ideal for activist or research DAOs. Pair with Dusk for hybrid setups: confidential core, compliant shell. This matrix reveals no one-size-fits-all; select per risk profile.

Challenges persist. Proof generation taxes computation, though 2026 optimizations slash times. FHE hybrids, as in Hedger, complement ZK for computations over encrypted data. My market tenure teaches: overlook latency, and agility suffers. Prioritize circuits optimized for treasury ops, like balance proofs or threshold sigs.

Looking ahead, Buterin’s pillars manifest. ZK dispute resolution settles treasury claims privately; on-chain efficiency scales governance. Protocols embedding FHE for verifiable privacy position DAOs for enterprise inflows. Zcash’s selective disclosure evolves into auditor portals, balancing openness with security.

Founders, act deliberately. Deploy ZK not as gimmick, but architecture. Test on testnets, iterate with oracles for off-chain signals. The result? Treasuries that maneuver like hedge funds: opaque to foes, transparent to verifiers. In this arena, zero-knowledge DAO treasury isn’t luxury; it’s the edge defining leaders from laggards. Prosperity follows those who encrypt strategically.