In the evolving landscape of decentralized governance, privacy-first DAOs are redefining how communities make collective decisions. As organizations scale on public blockchains, the transparency that once empowered trust now exposes vulnerabilities: individual votes sway under external pressure, and token balances reveal strategic positions to adversaries. Enter encrypted voting DAOs and confidential balances blockchain technologies, which promise verifiable outcomes without sacrificing member anonymity. Recent collaborations, like Inco and Tally’s push for trustless confidential voting, signal a maturing ecosystem where privacy isn’t an afterthought but the foundation of secure DAO governance privacy.

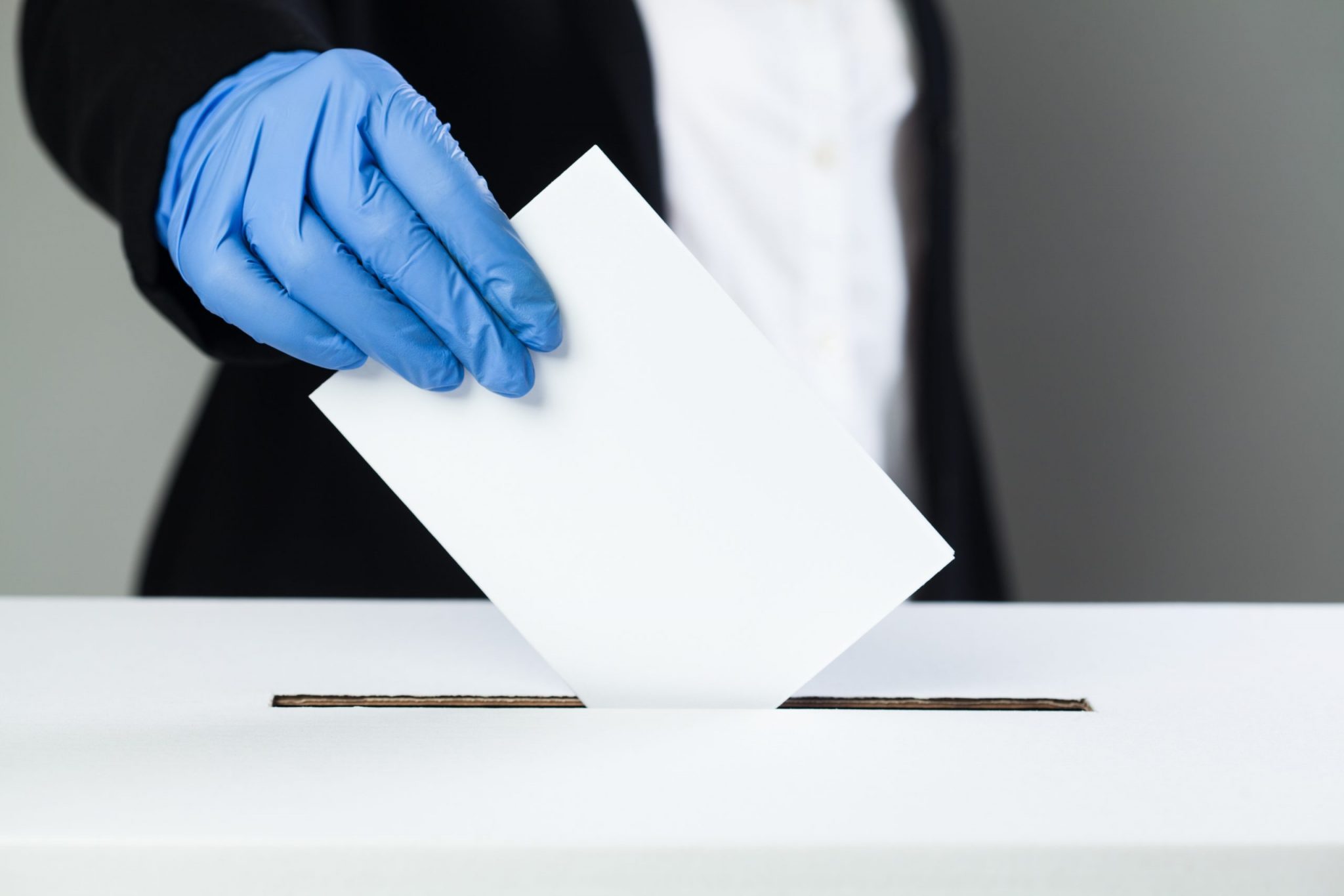

Consider the strategic implications. Public ledgers broadcast every proposal interaction, inviting vote-buying schemes or coercion from whales who track holdings in real-time. This herd mentality stifles dissent, as members self-censor to align with visible majorities. Yet, blockchain’s immutability demands solutions that maintain verifiability. Threshold encryption, as seen in Shutter’s Shielded Voting, encrypts individual choices during the voting window, decrypting aggregates only post-tally. This isn’t mere tech; it’s a bulwark against manipulation, enabling true decentralization.

Why Public Voting Undermines DAO Longevity

DAOs thrive on participation, but transparency breeds fragility. When votes are visible, sophisticated actors analyze on-chain data to predict and influence outcomes. A whale might dump tokens pre-vote to signal opposition, swaying smaller holders. Or nation-states monitor dissident groups via balance snapshots. In 2026, with DAOs managing billions, such exposures aren’t hypothetical; they’re quarterly headlines. Privacy-first DAO tooling counters this by obscuring intent while proving execution. Homomorphic encryption lets computations occur on ciphertexts, tallying votes without peeking inside envelopes.

DeFi apps can update encrypted balances mid-trade, DAOs can tally secret votes instantly.

This shift demands a big-picture rethink. Founders must prioritize protocols that embed privacy from inception, lest their DAO becomes a public spectacle vulnerable to regulatory scrutiny or internal fractures. Tools like Inco’s confidential governance demonstrate feasibility: votes encrypted, tallies verifiable, leaks nonexistent.

Threshold Encryption Unlocks Confidential Voting

Inco’s collaboration with Tally exemplifies the vanguard. Their solution encrypts voter decisions on-chain, hiding choices even from blockchain explorers. Distributed key generation ensures no single party controls decryption, aligning with DAO ethos. Post-vote, the system reveals outcomes trustlessly, mitigating front-running or bribery. Similarly, Shutter Network’s shielded pools protect against timing attacks, a common vector in transparent systems. For Azoth DAO encrypted voting experiments, integrating Inco with Nillion yields agentic DAOs where AI processes private data seamlessly.

Strategically, this empowers niche communities, think venture collectives or activist funds, operating under regulatory radars. Verifiability persists via zero-knowledge proofs, proving vote validity without disclosure. Yet adoption lags; most DAOs cling to Snapshot-style tools, blind to coercion risks. In my analysis, pivoting to these protocols isn’t optional; it’s portfolio armor for the next decade.

Explore how encrypted systems balance privacy and proof.

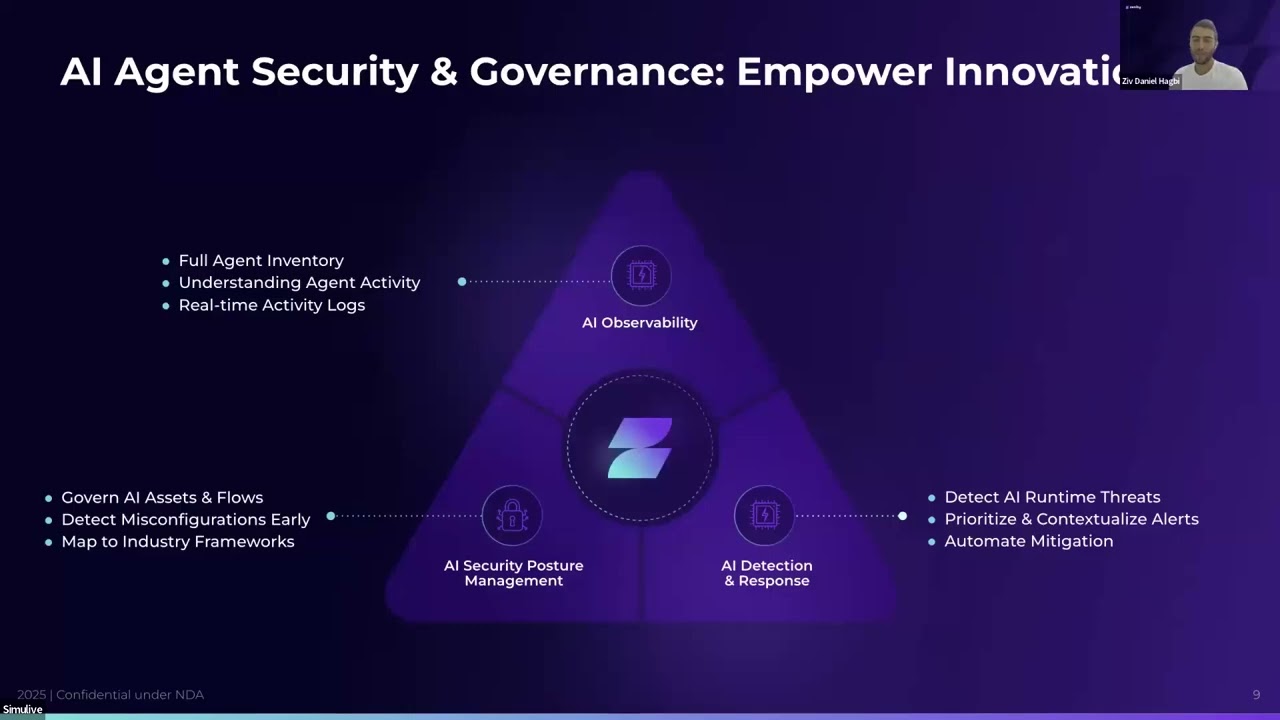

Confidential Balances: The Backbone of Private Operations

Beyond votes, confidential balances blockchain tech secures holdings via homomorphic schemes. Users prove solvency or quorum without exposing amounts, crucial for treasury management. Inco’s tokens shield DeFi interactions mid-trade, while Nillion’s blind computation processes off-chain data privately. This duo enables DAOs to execute proposals on hidden multisigs, thwarting sybil attacks rooted in wealth visibility.

Picture a DAO debating high-stakes investments: members vote encrypted, balances stay veiled, execution atomic. No more gaming quorums by timing dumps. As crypto matures, these primitives foster equitable power distribution, where merit trumps capital signals. Early adopters like Azoth DAO vercel prototypes hint at explosive growth, blending governance with confidential AI agents.

Implementing these layers requires deliberate architecture. Founders often grapple with integration friction: retrofitting legacy DAOs onto privacy stacks demands smart contract overhauls and oracle dependencies. Yet protocols like Inco streamline this via modular plugins for Tally Ho interfaces, preserving snapshot familiarity while encrypting payloads. Nillion’s blind compute complements by handling off-chain verifications, ensuring privacy first DAO tooling scales without central chokepoints.

Real-World Deployments and Lessons Learned

Azoth DAO’s vercel prototype stands as a beacon, fusing Inco’s confidential tokens with agentic workflows. Here, encrypted balances fuel private proposals; members signal investments sans exposure, AI agents optimize allocations on veiled data. Testing reveals tally speeds rival public systems, with zero-knowledge receipts proving integrity. Similarly, Shutter’s shielded voting has secured venture DAOs against whale predation, where pre-vote balance leaks once derailed multimillion allocations. These cases underscore a truth: secure DAO governance privacy isn’t boutique; it’s requisite for longevity amid rising state surveillance.

Key Privacy Advantages

-

Prevents coercion and vote-buying: Encrypted votes conceal individual choices on public blockchains using threshold encryption, as in Shutter’s Shielded Voting and Inco’s confidential governance.

-

Enables equitable participation: Confidential balances hide token holdings via homomorphic encryption, curbing whale influence for fairer DAO decision-making.

-

Shields from regulatory targeting: Private votes and balances minimize on-chain visibility, safeguarding DAOs from external regulatory pressures.

-

Supports confidential AI governance: Enables secure AI processing of encrypted data, powering agentic DAOs with Inco Network and Nillion.

-

Maintains full verifiability via ZK proofs: Zero-knowledge proofs validate tallies and integrity without exposing private details.

Challenges persist, chiefly usability. Threshold schemes demand multi-party coordination, inflating setup complexity. Gas premiums for homomorphic ops can deter mainnet pilots. Strategic founders mitigate via layer-2 migrations or subsidized testnets, prioritizing protocols with audited key gens. Inco’s test DAO trials, as shared on X, affirm viability: encrypted votes, verifiable tallies, governance privacy intact.

Confidential Voting: Each voter’s decision is encrypted, ensuring that their choices remain hidden, even on the public blockchain. Trustless.

Layer this with confidential balances, and DAOs unlock atomic executions. Multisig thresholds compute on ciphertexts, disbursing funds only upon private quorum proofs. No sybil inflation from visible wealth; power aligns to conviction, not capital. For macro portfolios, this reshapes risk: confidential DAOs weather bear markets insulated from panic cascades triggered by transparent dumps.

Dive into operational security via encrypted proposals.

The Road Ahead: Privacy as DAO Differentiator

By 2027, expect convergence: Inco-Nillion hybrids powering agentic collectives, Shutter expanding to cross-chain shields. Homomorphic upgrades will slash compute overheads, onboarding mass participation. Regulatory tailwinds favor this; jurisdictions probing DAO treasuries push for obscured ledgers. Founders ignoring encrypted voting DAOs risk obsolescence, their transparent skeletons picked clean by opportunists.

Strategically, embed privacy in charter DNA. Audit trails via ZK, governance sims on testnets, diversified tooling stacks. Azoth’s momentum signals a wave: confidential balances blockchain primitives enabling trillion-dollar ecosystems where anonymity fuels innovation. DAOs evolve from experiments to fortresses, meritocracies unmarred by visibility’s vices. The big picture? Privacy-first governance isn’t a feature; it’s the sovereign architecture for decentralized futures.