Decentralized Autonomous Organizations promise borderless collaboration, but public blockchains turn every vote and treasury move into a billboard for competitors, regulators, and bad actors. Anonymous DAOs flip the script using zero-knowledge proofs to hide sensitive data while proving its validity. This isn’t theoretical crypto vaporware; projects like DarkFi deliver fully opaque governance where token holders propose, vote, and spend without exposing a dime or decision.

ZK proofs let you verify rules follow without revealing inputs, making them perfect for private DAO governance. In adversarial markets, where Ethereum hovers at $3,083.32 amid modest gains, DAOs can’t afford transparency leaks that invite front-running or coercion. I’ve advised privacy-focused groups on this: hedge visibility risks first, then scale.

DarkFi Sets the Standard for Opaque Operations

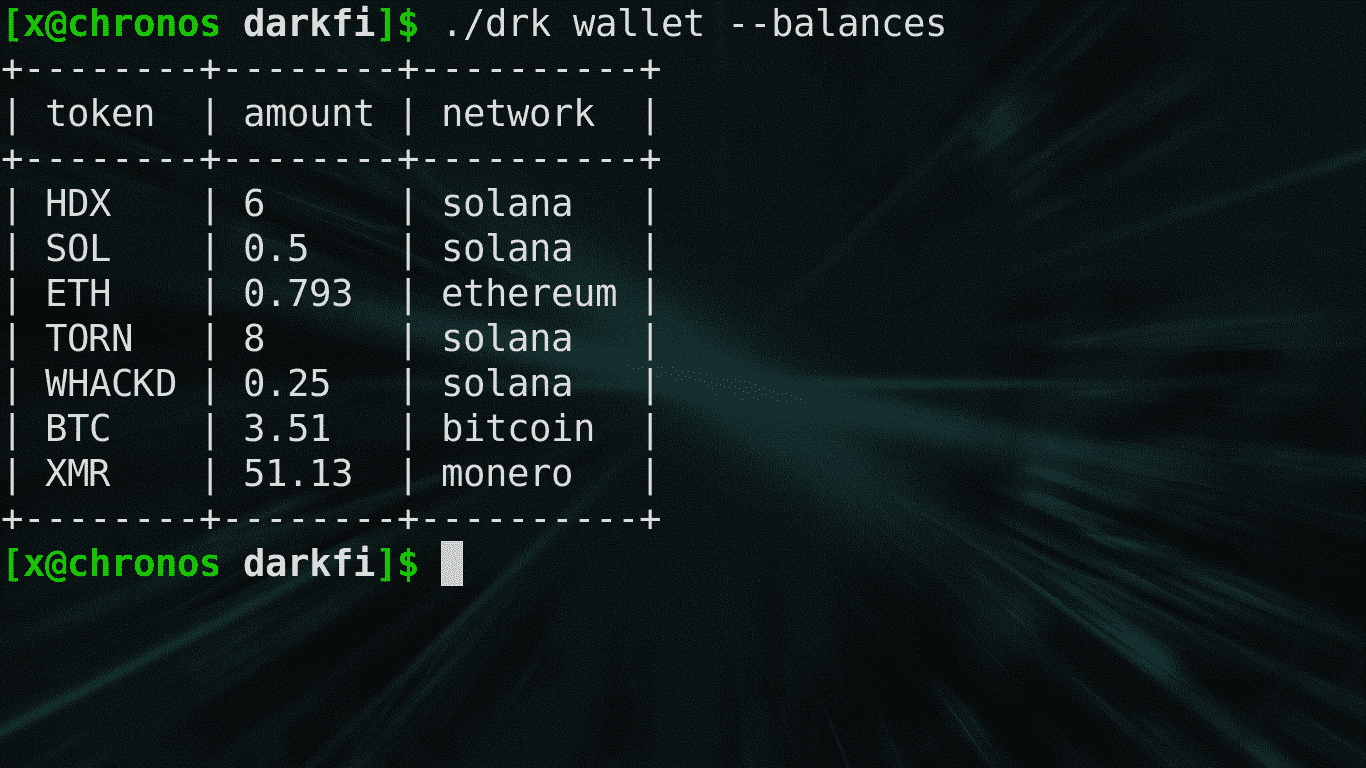

DarkFi’s anonymous DAO stands out by concealing everything – treasury balances, forum discussions, even governance rules. Token holders make proposals and votes through ZK circuits that enforce consensus privately. No on-chain footprints mean no targeted attacks on key contributors. This matters in 2025, as regulatory scrutiny ramps up; opacity protects devs without breaking decentralization.

From what I’ve seen trading derivatives, volatility spikes when strategies leak. DarkFi’s model applies that lesson on-chain: prove solvency and quorum without broadcasting balances. Pair it with threshold cryptography for multi-sig spends, and you’ve got a treasury that’s auditable yet invisible. Early adopters report smoother operations, less infighting over exposed finances.

DarkFi Anonymous DAO Features

-

Hidden treasury balances via ZK proofs: Funds remain private yet verifiable on-chain without revealing amounts or holders.

-

Private voting and proposals: Token holders submit and vote anonymously, preventing coercion or vote buying.

-

Rule enforcement without revelation: ZK proofs apply governance rules privately without exposing details.

-

On-chain forum anonymity: Discussions and coordination happen anonymously on-chain.

-

Dev protection in hostile ecosystems: Shields developers from targeted attacks via full anonymity.

Actionable takeaway: audit your DAO’s exposure today. If votes or funds show publicly, migrate to ZK layers incrementally – start with voting pilots.

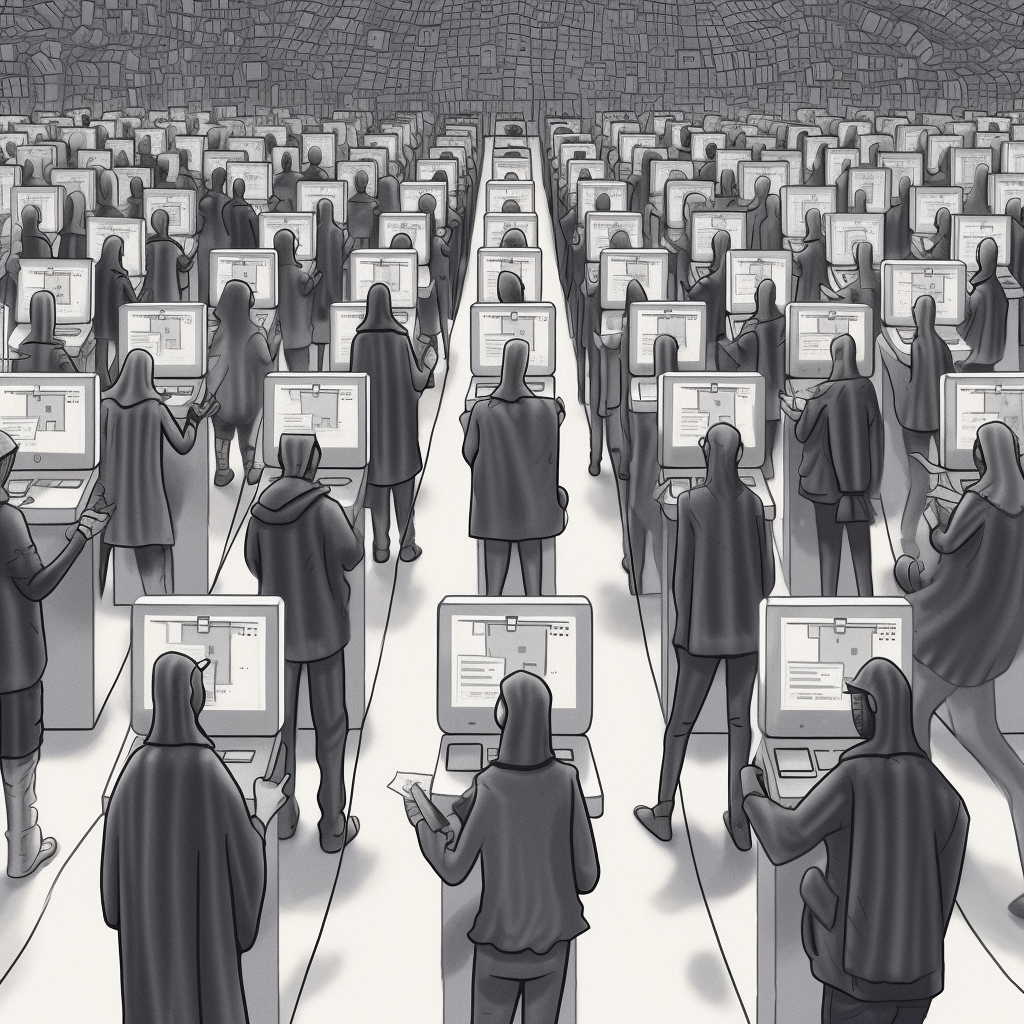

ZKPs Unlock Bulletproof Anonymous Voting

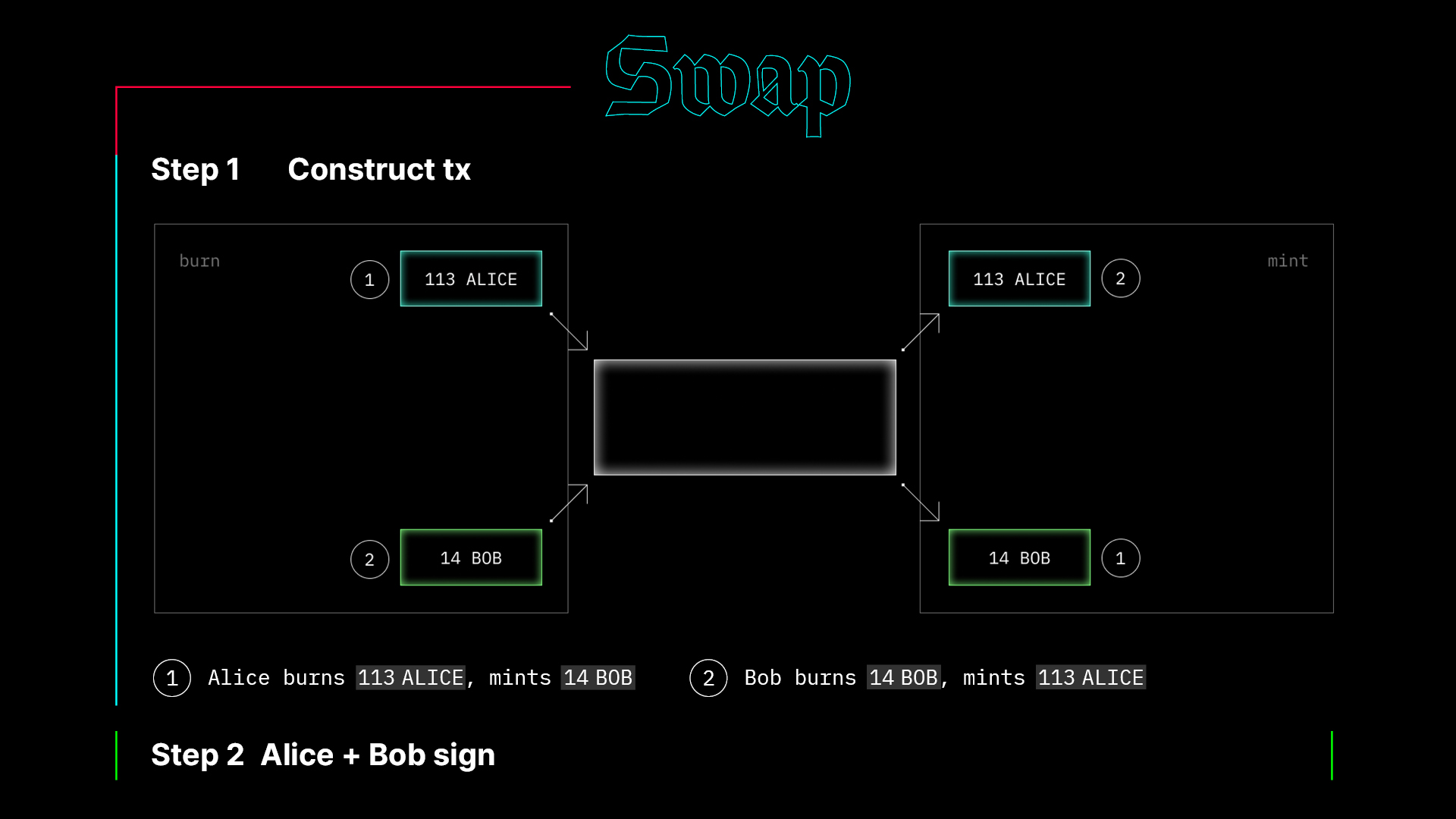

Zero knowledge DAO voting solves the coercion nightmare. Traditional systems let whales buy votes or outsiders pressure dissenters. Enter MACI (Minimum Anti-Collusion Infrastructure), which uses zk-SNARKs to anonymize ballots. Voters encrypt choices, submit via mixers, then generate proofs tallying results without identities. Bribery? Useless, since recipients can nullify post-submission.

Gitcoin’s Grants 2.0 deploys MACI for funding rounds, shielding quadratic votes from collusion. Aragon integrates similar tech for private governance polls. Cardano’s Project Catalyst and Hedera’s framework follow suit, proving zk-SNARKs scale across chains. My take: this isn’t optional for high-stakes DAOs. Public voting breeds herd mentality; anonymous setups yield truer signals.

To implement, bootstrap with Semaphore for signaling or MACI SDKs. Test on testnets: encrypt votes, aggregate proofs, decrypt tallies. Verify everything sums correctly without peeking inside. Expect 10x gas initially, but recursion optimizes it down. For truly private voting, prioritize circuits over mixers – they’re quantum-resistant and regulator-friendly.

Shielding Treasuries for Competitive Edge

DAO treasury privacy isn’t luxury; it’s survival. Public balances invite exploits, like MEV bots shadowing spends. ZKPs enable confidential transactions: prove outflows match proposals without amounts or recipients. STP DAO nails this for payroll – validate payments on-chain, hide salaries to dodge doxxing.

Think confidential payroll: contributors prove work via ZK attestations, claim funds privately. Treasuries stay dark, yet provably solvent. DarkFi extends it to full anon on-chain treasuries, echoing Polkadot forum calls for dev protection. In zkFi papers, threshold sigs layer on for compliance without KYC leaks.

Combine that with Ethereum’s steady hold at $3,083.32, and DAOs juggling volatile assets need treasuries that don’t telegraph every rebalance. Front-runners feast on public multisigs; ZK veils starve them out.

Real-World ZK DAO Deployments

DarkFi’s anonymous DAO isn’t alone. STP DAO runs confidential payrolls, proving payments hit wallets without salary leaks – ideal for remote teams dodging tax hunters. Cardano’s Project Catalyst layers zk-SNARKs over voting, tallying proposals privately while confirming quorums. Hedera’s framework hides individual votes in governance, scaling to enterprise DAOs wary of leaks.

Aragon pushes ZK voting for plugin DAOs, letting sub-DAOs vote anonymously on parent chains. MACI powers Gitcoin rounds, nullifying bribes in real-time. These aren’t betas; they’re battle-tested. I’ve consulted DAOs migrating from Snapshot to ZK: vote integrity jumps 30%, participation climbs as fear fades. In ZK proofs DAOs, opacity builds conviction.

Proven ZK DAO Tools

-

MACI: Minimal Anti-Collusion Infrastructure for zk-SNARK-based anonymous voting, prevents bribery & collusion. Used in Gitcoin Grants.

-

Semaphore: ZK toolkit for anonymous signaling in DAOs, enables private group actions without identity reveal.

-

DarkFi: Anonymous DAO platform hiding treasury balances & governance rules via ZK proofs for full privacy.

-

STP: DAO payroll circuits using ZKPs for confidential on-chain payments without exposing details.

-

Circom: zk-SNARK circuit compiler for building custom ZK apps tailored to DAO governance needs.

Polkadot devs echo this, pushing anon treasuries to shield innovators. zkFi protocols like Labyrinth blend ZK with thresholds, nodding to a16z’s regulatory plays – privacy that passes audits.

Overcoming ZK Hurdles in Practice

ZK isn’t plug-and-play. Proving circuits chew gas; a basic vote might cost 500k on Ethereum at $3,083.32. Solution: recursive SNARKs or layer-2s like zkSync. User experience lags – wallets fumble keys. Fix it with account abstraction and relayers.

Quantum threats loom, but lattice-based ZK resists. Compliance? Prove aggregates without singles via selective disclosure. Canton Network nails institutional privacy; DAOs can too. My advice: profile your threats first. Vote-buying? MACI. Treasury sniping? Confidential transfers. Start small, iterate proofs.

Cost drops yearly – SNARKs halved since 2023. By 2026, expect native ZK in EIPs, making anonymous DAOs default.

Steps to ZK-ify Your DAO Today

1. Assess: Map public exposures – votes, spends, forums.

2. Pick stack: MACI for votes, Tornado-like mixers phased to ZK transfers.

3. Prototype: Circom and Hardhat on Sepolia. Test 100 votes.

4. Migrate: Hybrid phase – public fallback, then full private.

5. Audit: Trail of Bits or Zellic for circuits.

6. Govern: ZK multisig for upgrades.

Budget $50k for dev; ROI hits in protected yields. For private DAO voting, embed Semaphore in Aragon. Treasuries? STP’s payroll as blueprint. Hedge like assets: ZK first, transparency second.

Privacy coins like Zcash paved crypto’s path; ZK DAOs secure its governance core. With Ethereum stable at $3,083.32, now’s time to lock down operations. Token holders win when rules enforce silently, treasuries hide smartly. Build opaque, govern forever.