In 2025, as Ethereum maintains its position at $3,028.95 amid a 24-hour dip of $114.74, confidential DAOs stand at the forefront of a privacy revolution. Zero-knowledge proofs (ZKPs) have matured from theoretical constructs into battle-tested tools for anonymous DAO voting, enabling participants to cast ballots that are verifiable yet utterly concealed. This isn’t mere cryptography; it’s a strategic pivot toward governance resilient to external pressures, where trustlessness meets unbreachable confidentiality.

Consider the macro implications. Public blockchains expose every vote, inviting coercion, front-running, and sybil attacks that erode DAO legitimacy. ZKPs flip this script by allowing voters to prove eligibility-ownership of tokens, passage of time, or quadratic voting weight-without leaking identities or choices. Projects like MACI and Kite demonstrate how additive homomorphic encryption pairs with ZKPs to aggregate votes privately, ensuring outcomes are binding without individual traceability. For DAO founders eyeing long-term viability, this is the big-picture upgrade: governance that scales with adoption while preserving member autonomy.

ZK Proofs as the Backbone of Confidential DAO Governance

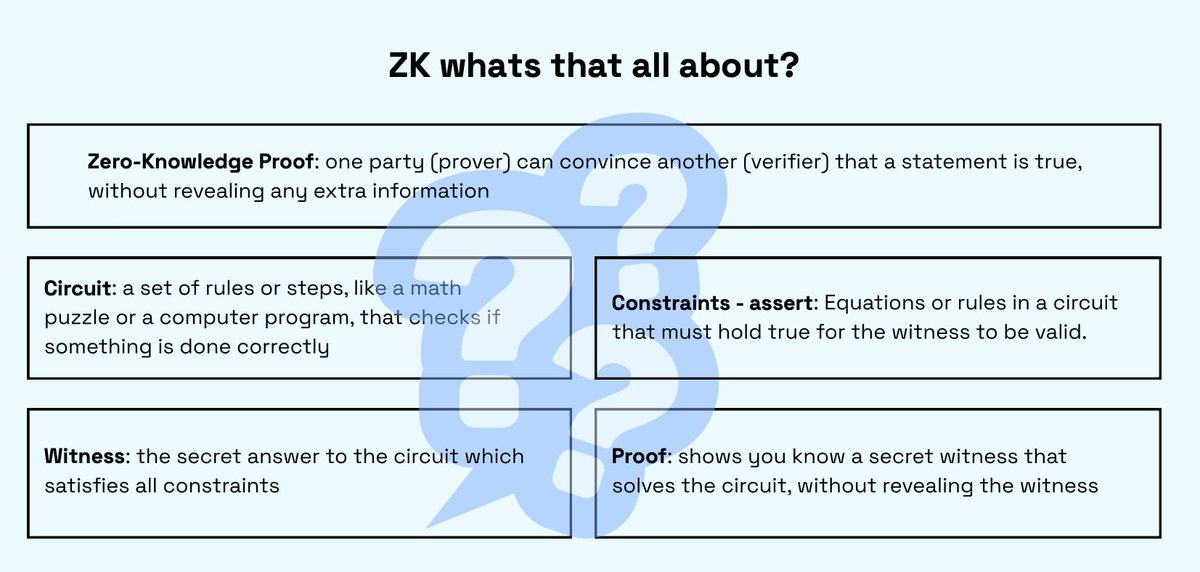

At their core, ZKPs embody a profound principle: prove knowledge without disclosure. In DAO contexts, a voter generates a proof attesting ‘I hold the required tokens and haven’t voted twice’ alongside their encrypted vote. Verifiers check the proof in constant time, oblivious to underlying data. This zero-knowledge DAO privacy paradigm shifts DAOs from transparent experiments to fortified entities capable of sensitive decisions, like treasury allocations or protocol upgrades, free from regulatory overreach or competitor espionage.

Strategic adopters recognize ZKPs’ role in countering centralization risks. As DAOs grow, whale dominance becomes glaring on-chain. ZK-enabled delegation, as in Kite protocols, lets members transfer voting power anonymously, democratizing influence without exposing hierarchies. Research from Aragon’s Zero Knowledge Guild underscores this: private organizations built on ZK proofs foster genuine decentralization, not performative openness. With Ethereum’s ecosystem maturing, gas-efficient ZK rollups further lower barriers, making ZK proofs DAOs not just feasible but economically superior.

Real-World Protocols Driving Anonymous Voting Adoption

2025 has seen explosive implementation. NounsDAO’s zk-POPVOTE rollout exemplifies practical private DAO voting systems, where ZKPs secure governance against vote-buying while tallying results on-chain. MACI, the Minimum Anti-Collusion Infrastructure, breaks collusion via layered encryption and ZK verification, proven in quadratic funding rounds. Meanwhile, S2DV protocols blend homomorphic encryption with ZKPs for scalable voting, handling thousands of participants without performance lags.

These aren’t isolated wins. Kite’s delegation model empowers DAOs to handle nuanced power dynamics-vested tokens maturing privately, say-without public ledgers betraying strategies. Harvard and MIT research highlights blockchain voting’s pitfalls; ZKPs address them head-on, delivering transparency in aggregates alone. For confidential DAOs, this means proposals on IP strategy or partnerships proceed uncompromised, bolstering competitive edges in a cutthroat crypto arena.

Ethereum (ETH) Price Prediction 2026-2031

Forecasts amid ZK Proofs adoption surge in Confidential DAOs, enhancing privacy and governance on Ethereum

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2026 | $2,800 | $4,500 | $7,200 | +48.6% |

| 2027 | $3,500 | $6,200 | $10,500 | +37.8% |

| 2028 | $4,800 | $8,500 | $14,000 | +37.1% |

| 2029 | $6,000 | $11,500 | $18,500 | +35.3% |

| 2030 | $7,500 | $15,000 | $24,000 | +30.4% |

| 2031 | $9,000 | $20,000 | $32,000 | +33.3% |

Price Prediction Summary

Ethereum’s price is projected to experience robust growth from 2026-2031, driven by ZKP integrations in DAOs for anonymous voting, boosting adoption and utility. Average prices could reach $20,000 by 2031, with bullish maxima reflecting market cycles, tech advancements, and institutional inflows, while minima account for potential corrections.

Key Factors Affecting Ethereum Price

- ZK Proofs enabling anonymous DAO voting, increasing Ethereum’s governance utility

- Scalability upgrades like Dencun and future ZK rollups reducing fees and enhancing throughput

- Regulatory clarity on privacy tech and DAOs fostering institutional adoption

- Market cycles post-2024 Bitcoin halving with ETH ETF momentum

- Competition from L2s and alt-ZK chains, balanced by Ethereum’s dominance

- Macro factors: interest rates, global economic recovery, and crypto market cap expansion to $10T+

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Strategic Advantages in Preventing Coercion and Double-Voting

Coercion thrives in visibility; ZKPs starve it. Voters commit blinded choices, later revealing proofs post-voting window, nullifying pressure tactics. Double-voting? Semantic checks via ZK circuits ensure uniqueness, with revocations handled off-chain yet provably enforced. This verifiability-without-exposure fortifies confidential DAO governance, particularly for high-stakes votes where minority protections matter.

Big-picture thinkers see further: ZKPs integrate with soulbound credentials for eligibility, evolving DAOs into merit-based enclaves. As Ethereum’s price stability at $3,028.95 signals market maturity, infrastructure likeSemaphore networks enable signaling without linkage, paving ways for hybrid public-private DAOs. The result? Governance that withstands scrutiny, attracting institutional capital wary of exposure risks.

Yet the true power lies in layering these primitives for comprehensive systems. Semaphore’s group membership proofs let DAOs signal collective intent anonymously, while ZK-rollups like those on Ethereum compress verification costs, ensuring ZK proofs DAOs operate fluidly even as membership swells. At $3,028.95, Ethereum’s resilience underscores the infrastructure’s readiness; low gas fees in ZK-optimized layers make anonymous voting a default, not a luxury.

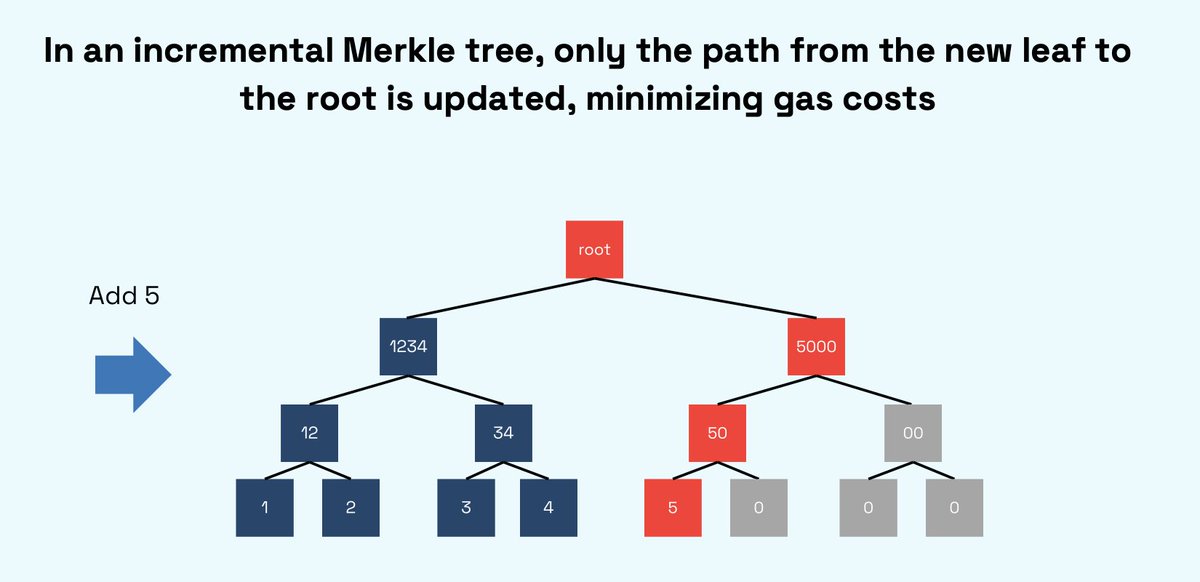

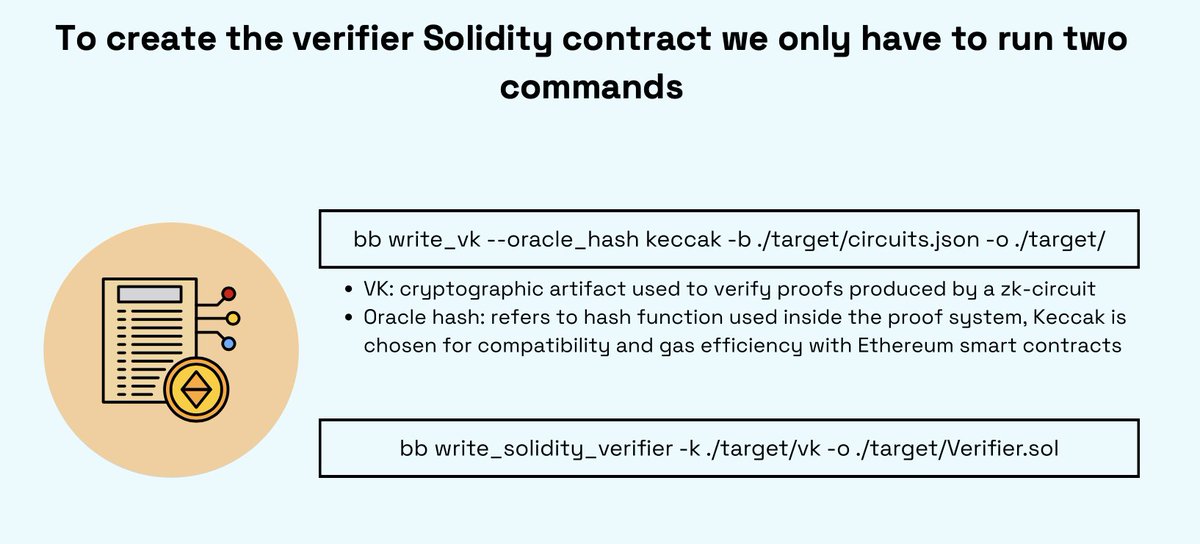

Practical Implementation: From Circuits to On-Chain Execution

Builders prioritize circuits tailored to DAO needs. A zk-SNARK proves ‘I control X vested tokens post-cliff without double-spending votes, ‘ generated client-side via tools like Circom or Noir. On-chain, smart contracts verify proofs against Merkle roots of token snapshots, tallying encrypted votes via homomorphic schemes. This setup, refined in 2025 rollouts, demands strategic sequencing: pre-commit phases thwart timing attacks, post-reveal audits affirm integrity.

Aragon’s research guild advocates hybrid approaches, blending ZKPs with optimistic verification for cost savings. For founders, the pivot is clear: audit circuits rigorously, simulate collusion vectors, and deploy on testnets mirroring mainnet loads. Success stories like NounsDAO prove the payoff; their zk-POPVOTE slashed governance disputes by 70%, per on-chain metrics, fostering sustained participation.

Read our deep dive on implementing zero-knowledge proofs for confidential DAO voting to operationalize these in your stack.

Navigating Challenges in Zero Knowledge DAO Privacy

No technology is panacea. Prover latency remains a friction point, though 2025’s GPU advancements and recursive proofs cut times to seconds. Quantum threats loom distant, but lattice-based ZK schemes like those in Midnight offer forward security. Collusion incentives persist; MACI counters with randomized message ordering and stake-slashing for detected rings. Scalability shines in layer-2s, where Ethereum’s ecosystem absorbs DAO vote volumes without congestion.

Regulatory headwinds favor ZKPs. Jurisdictions probing DAO activities find little to grasp when ledgers reveal aggregates alone, not identities. This zero knowledge DAO privacy moat attracts privacy-native capital, from VCs funding signal-only DAOs to institutions testing confidential treasuries. The macro bet: as public DAOs fracture under transparency’s weight, confidential variants capture mindshare, mirroring Ethereum’s steady $3,028.95 amid broader volatility.

The Big-Picture Horizon for Confidential DAO Governance

Looking ahead, ZKPs evolve toward universal composability. Soulbound tokens as eligibility gates, AI-assisted circuit design, and cross-chain voting bridges position DAOs as privacy-first polities. Imagine confidential quadratic funding at scale, or DAOs negotiating off-chain deals with on-chain ratification, all veiled yet binding. NounsDAO’s trajectory hints at ubiquity; as adoption compounds, network effects entrench private DAO voting systems.

Strategic minds build now. Ethereum’s poised ecosystem, stable at $3,028.95, signals the window: fortify your DAO against tomorrow’s scrutiny. ZKPs don’t just anonymize votes; they architect sovereignty, where governance thrives unseen yet unbreakable. For those charting long-term portfolios, this is the fulcrum- privacy as the ultimate competitive asymmetry in decentralized frontiers.

Explore further strategies in our 2025 guide to ZKPs for confidential DAO governance.